Bull or Bear? Unveiling the Current State of Silver with YouTuber Alessio Rastani

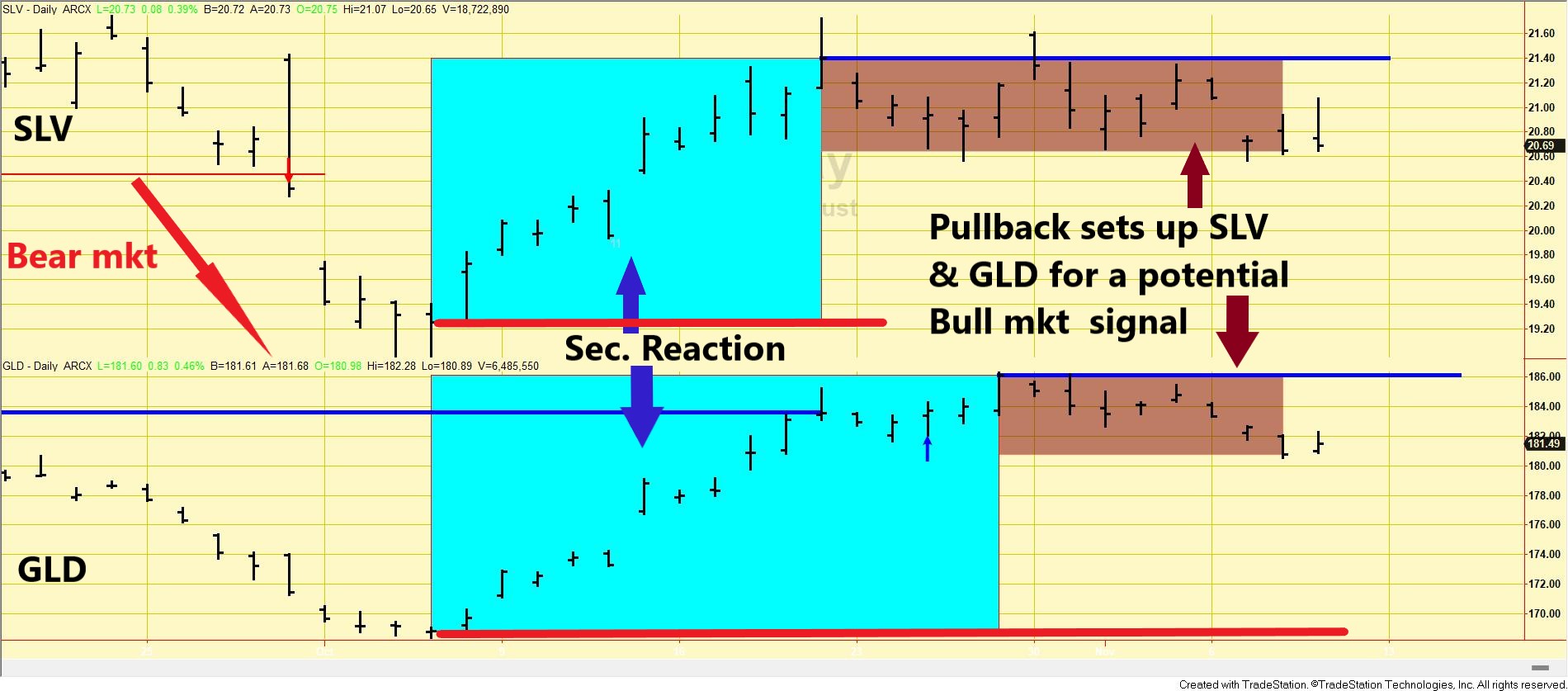

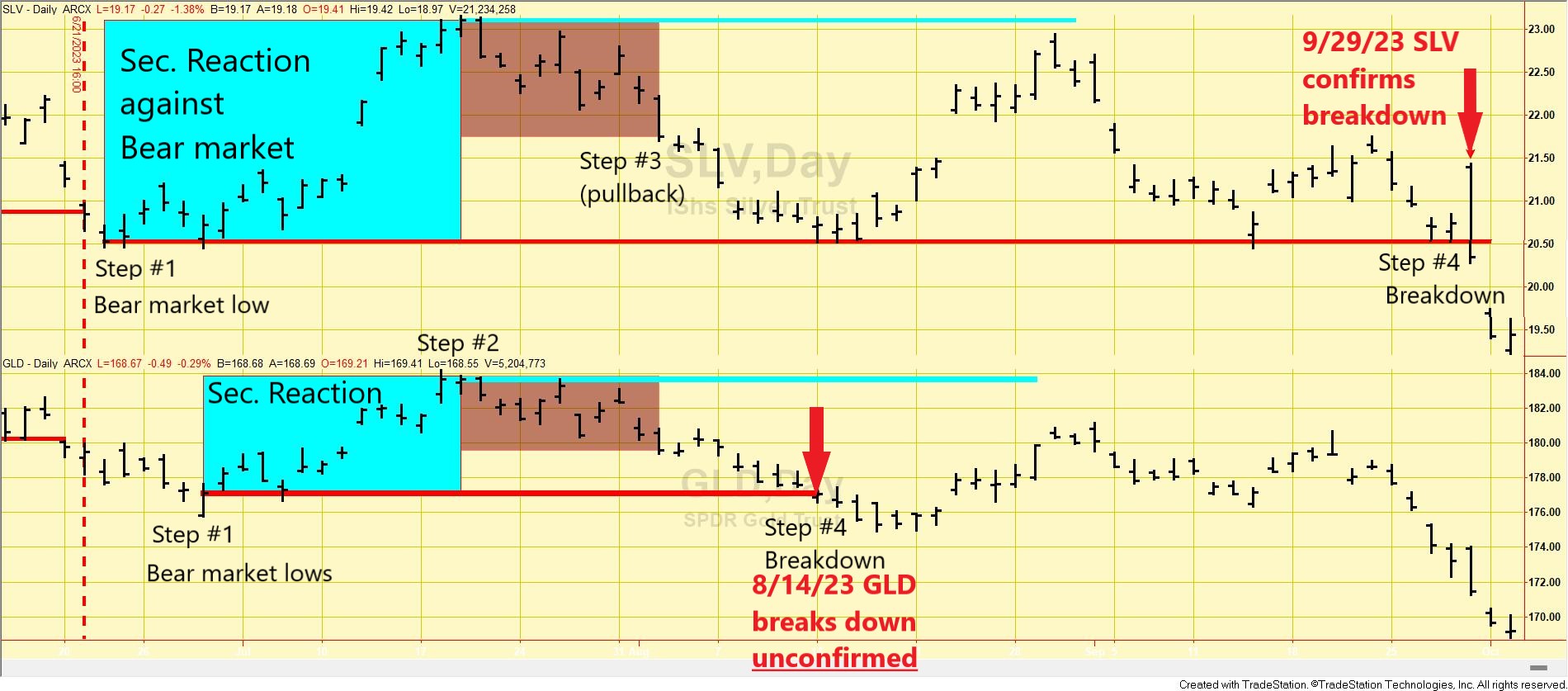

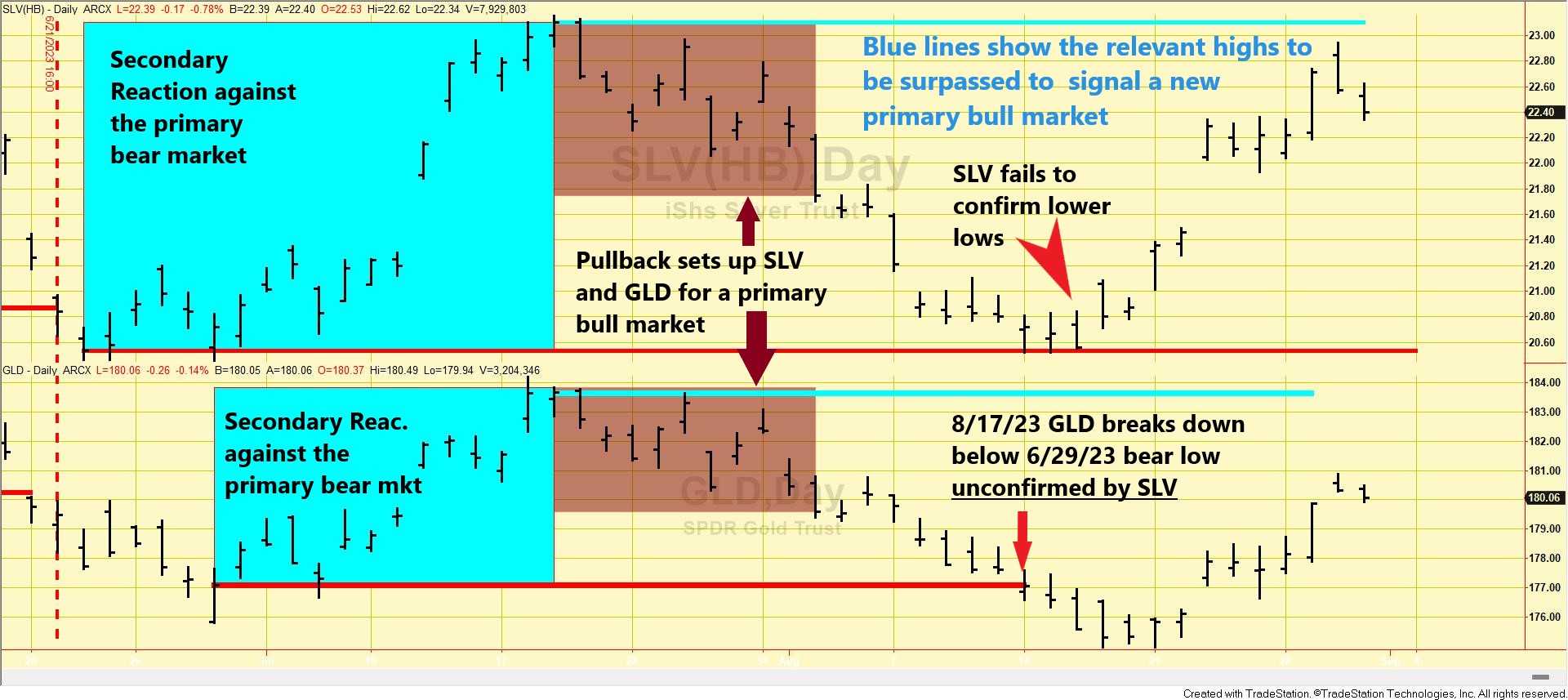

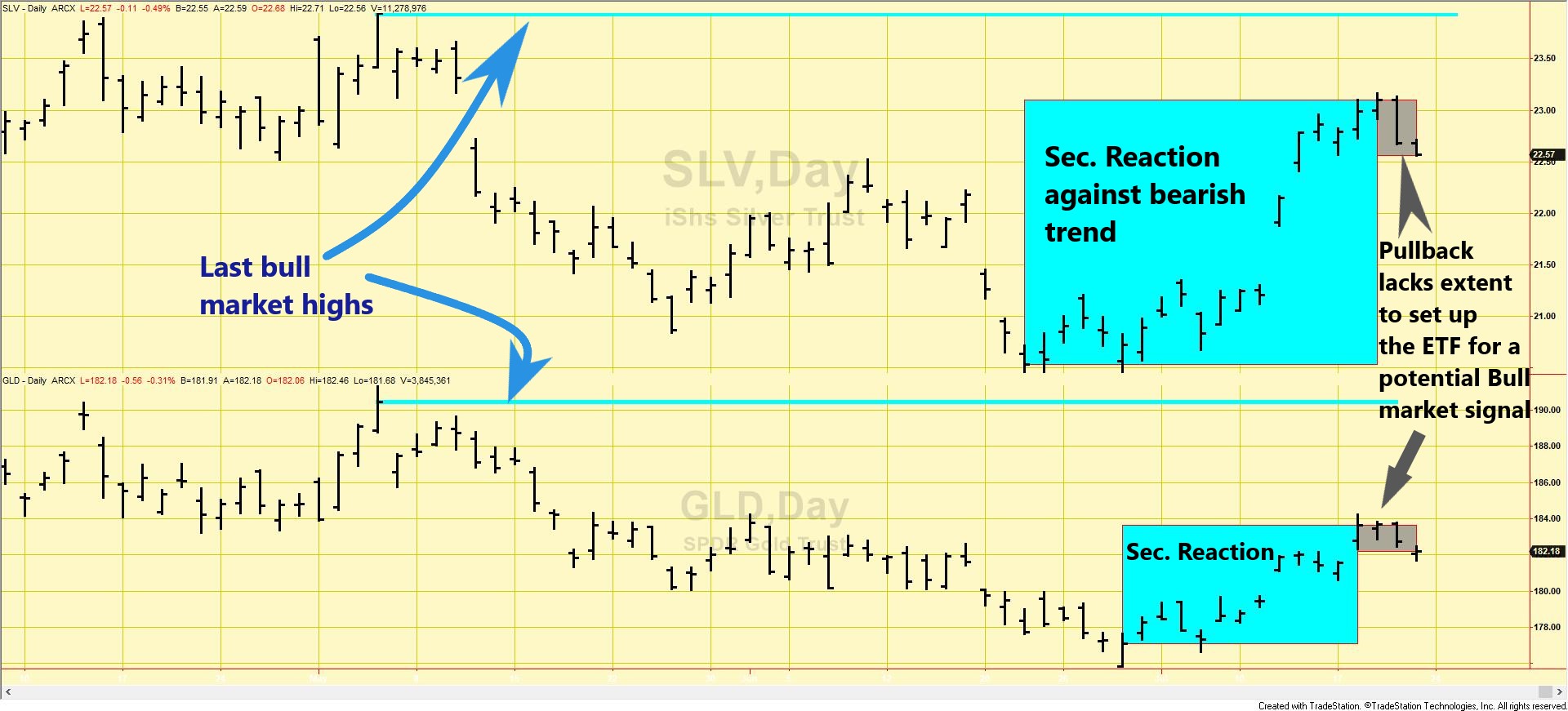

In our latest episode, Alessio Rastani and I discuss the current state of the silver market. After rallying from its October lows, silver has experienced a recent pullback, prompting us to analyze whether the silver chart is currently exhibiting bullish or bearish signals. To watch the video, click on the image below.