Category: Investment musings

How a Falling ERP Isn’t the Bearish Sign You Thought It Was

posted on: January 23, 2024

Dispelling another investment myth Is a falling Equity/Risk Premium (ERP) bearish for stocks? No, it isn’t. Jay Kaeppel (HERE) debunks another investment fallacy by showing that a falling ERP does not influence the stock market. So, a relatively low yield of stocks vs. bonds has zero predictive power of future performance. Actually, as shown in […]

Is the U.S. stock market overvalued?

posted on: January 18, 2024

Perhaps it is, but there aren’t many alternatives left I’m not a staunch supporter of fundamentals, but if there’s one I truly endorse, it’s economic freedom as a predictor of future prosperity. The freer the market, the more prosperous the nation, and its stock market mirrors this. Therefore, it doesn’t make sense to me to […]

Use and misuse of the Dow Theory

posted on: January 13, 2024

Not everything touted as Dow Theory is the real thing. No technical analysis system is more abused than the Dow Theory. Some individuals peddle their eccentric notions under its banner to profit from its respectable track record, misrepresenting them as Dow Theory to make a catchy headline. A recent case involves the confusion between the […]

Bull or Bear? Unveiling the Current State of Silver with YouTuber Alessio Rastani

posted on: November 13, 2023

In our latest episode, Alessio Rastani and I discuss the current state of the silver market. After rallying from its October lows, silver has experienced a recent pullback, prompting us to analyze whether the silver chart is currently exhibiting bullish or bearish signals. To watch the video, click on the image below.

Decoding Bitcoin’s Path: A Rule of 7 Exploration with Alessio Rastani

posted on: November 9, 2023

Join me in a candid Bitcoin discussion with Alessio Rastani. We explore future price objectives using the Rule of 7 and delve into when market corrections might occur. Check out the full interview by clicking the image below for insightful analysis.

Exploring Market Headwinds and Future Scenarios with Alessio Rastani

posted on: November 6, 2023

Navigating Stock Market Challenges: Insights from a Recent YouTube Interview I want to thank Alessio Rastani for having me on his YouTube channel. It was a fantastic experience talking about the current state of the stock market. We covered the two significant challenges that could potentially keep the S&P500 from hitting all-time highs in the […]

Dow Theory Analysis Featured in ‘Markets Insider’: Implications of Recent SELL Signal

posted on: October 23, 2023

I thank Matthew Fox for quoting my Dow Theory analysis in “Markets Insider”. As stated in Matthew’s article, on 10/23/2023, the Dow Industrials broke down below its 10/3/23 closing lows, triggering a SELL signal. The table below shows the most relevant price action that led to the 10/23/23 Sell signal. Historical data from 1953 reveals […]

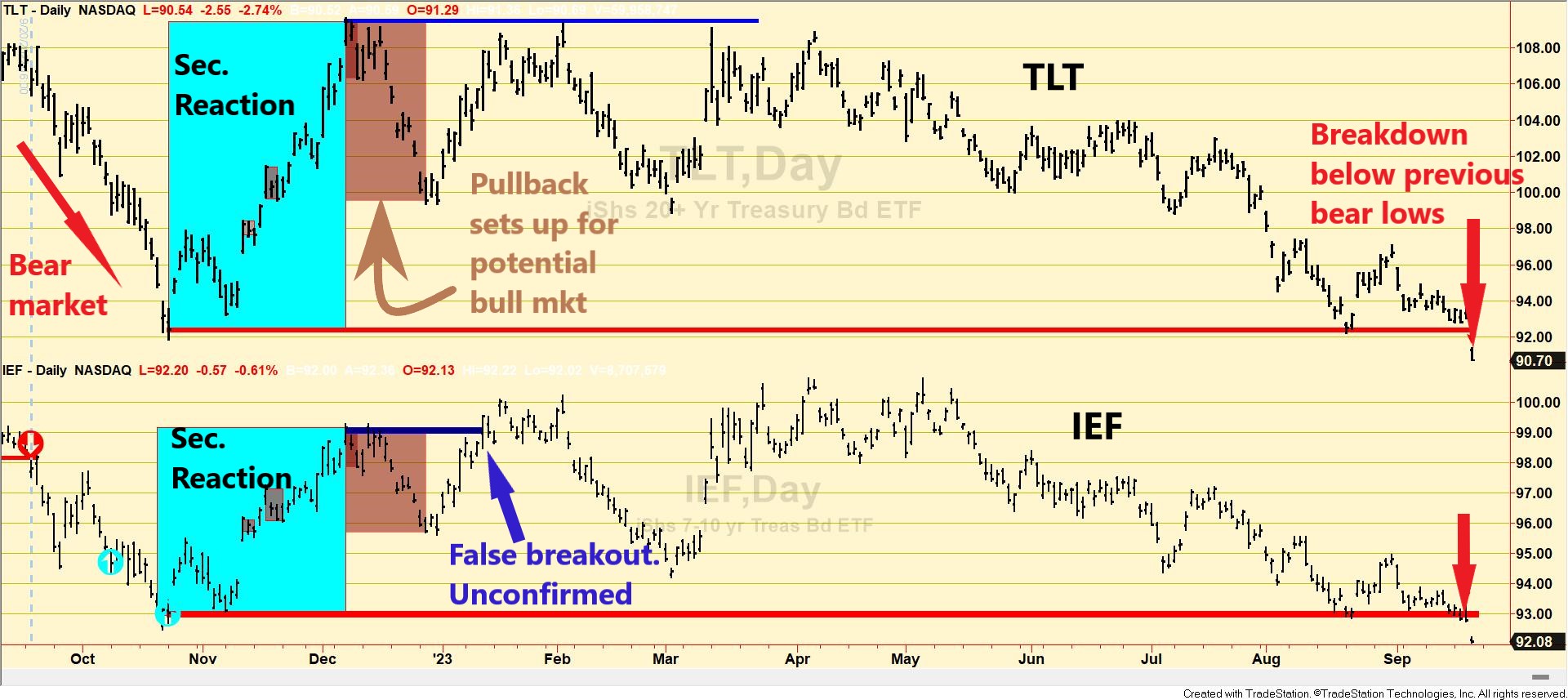

Dow Theory Update for September 21: Primary bear market in U.S. bonds reaffirmed on 9/21/23

posted on: September 21, 2023

The bear market in bonds continues… General Remarks: In this post, I thoroughly explained the rationale behind my use of two alternative definitions to appraise secondary reactions. TLT is the iShares 20 years + Treasury bond ETF. More about it here IEF is the iShares 7-10 years Treasury bond ETF. More about it here. Thus, […]

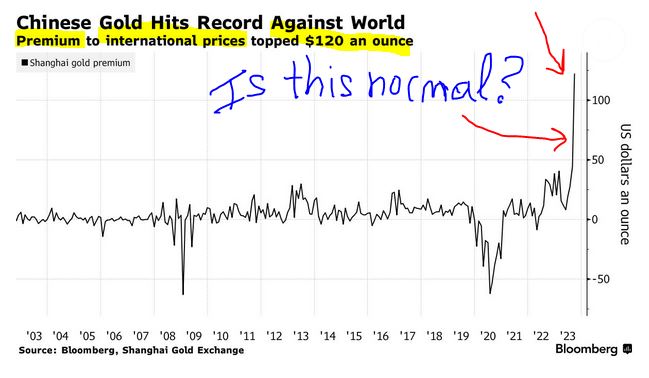

Dow Theory Update for September 19: No changes in trends but something is going on with gold

posted on: September 19, 2023

All the last updates I produced for gold/silver, GDX/SIL, and TLT/IEF and the U.S. stock market remain unchanged. Markets are like a coiled spring, and the final breakout will likely carry out significant follow-through. However, while markets remain range-bound, something is going on with physical gold. I recently found a Bloomberg article indicating that Shanghai’s […]

Dow Theory Update for July 20: Heretical Interpetations of the Dow Theory (II)

posted on: July 21, 2023

Not everything promoted as “Dow Theory” is the correct Dow Theory In four past posts (here, here, here, and here I debunked what I believe are incorrect and underperforming interpretations of the Dow Theory. The Dow Industrials’ newer highs have sparked claims from various “Dow Theory experts” that a new Bull market has emerged, which […]

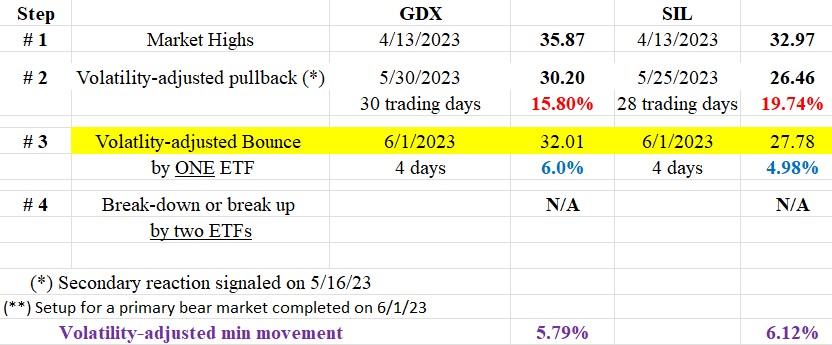

Dow Theory Update for June 2: Setup for a primary bear market signal for GDX and SIL completed on 6/1/23

posted on: June 9, 2023

I am writing before the close of 6/2/23. So readers, beware, things may change. Executive Summary: 1. The primary trend for gold and silver is bullish, the secondary one is bearish, and the setup for a potential primary bear market signal was completed on 6/1/23. Soon I will write a post. The primary trend for […]

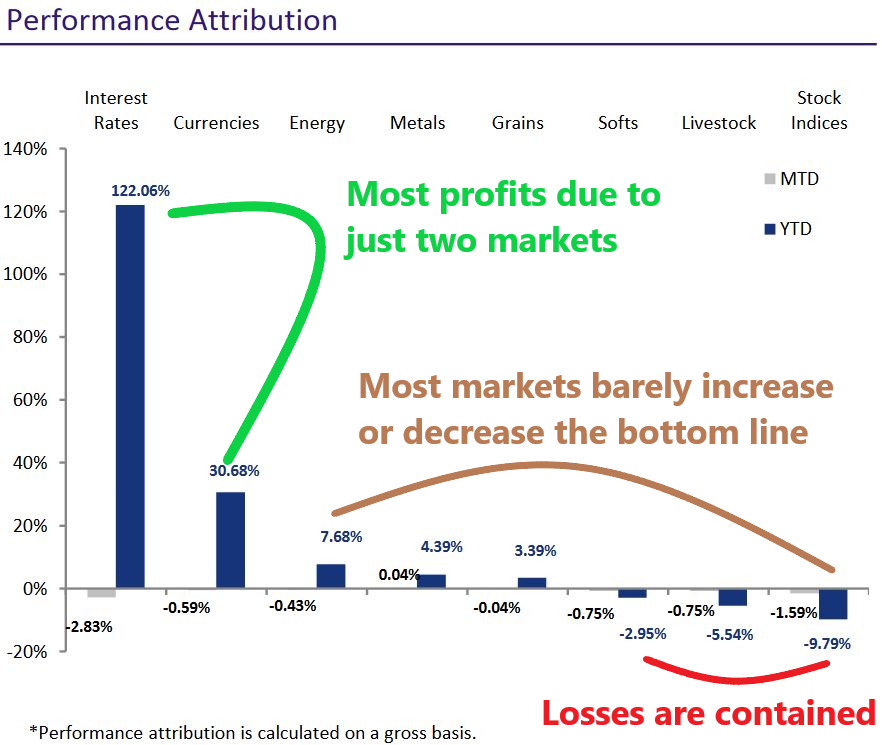

Dow Theory Update for November 8: The typical profit/loss profile in trend following

posted on: November 8, 2022

And don’t forget the Dow Theory is trend following! Trend following works, BUT you must be willing to accept that most trades will be small winners, and some will be losers. Eventually, if one is patient, one strong trend will emerge, and profits on that trade will make for all small losses and then some. […]

Back To Top