Category: Investment musings

Dow Theory Update for October 28: The four requirements of a good trend following system

posted on: October 28, 2022

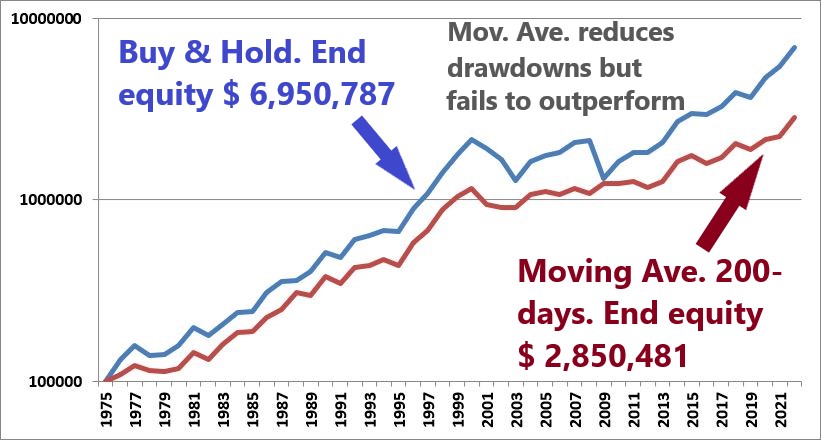

Good (and less good) trend following This is an important post as it will dispel some trend-following myths. I plan to expand this post in the future or write additional posts on this subject. What makes an excellent trend-following system? A good trend-following system must meet four requirements: […]

Dow Theory Update for October 20: Comparing the 1987 and 2020 stock market crashes.

posted on: October 19, 2022

As promised yesterday, I am reproducing and updating one post I penned two years ago comparing the 1987 and 2020 stock market crashes. Yesterday, October 19th was the 35th anniversary of the 1987 stock market crash. I wrote about it in the past and made clear that the Dow Theory (of any flavor whatsoever) […]

Dow Theory Update for October 13: Even “normal” trend following works if you are patient.

posted on: October 13, 2022

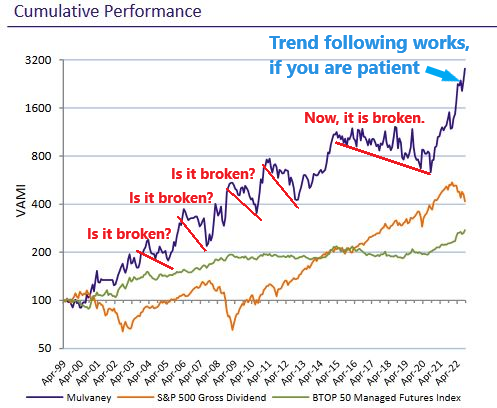

Trend following works BUT most people cannot digest the spells of underperformance and/or drawdowns that inevitably occur. You must be patient and control your fears. The chart below is taken from the October monthly report of a very successful trend-following fund with a track record starting in April 99. The red lines show all […]

Dow Theory Update for August 15: Update on the trend for U.S. bonds on Alessio Rastani YouTube channel

posted on: August 15, 2022

Famed Youtuber and successful trader Alessio Rastani and I have been discussing the current trend for U.S. bonds and its implications for the economy. Click on the link below to see the interview: https://www.youtube.com/watch?v=ey0SPpb6BXk&t=2s And to see our past interview on gold: https://www.youtube.com/watch?v=pG7j0aXlXx8&t=3s I highly recommend Alessio’s channel. It is loaded with great, enjoyable, and […]

Can the Dow Theory be applied to Sectors? Answer: YES

posted on: June 10, 2022

Can the Dow Theory be successfully applied to sectors? Yes, and it works great. In most cases, there is even more outperformance and drawdown reduction versus Buy and Hold than when applied to Indexes. In a future post, I will explain why the Dow Theory works with sectors and what sectors stand to profit most […]

Dow Theory Update for May 13: All investing strategies need protection against bear markets. Three examples. Make no mistake about it.

posted on: May 13, 2022

A brief update on the trends for U.S.U.S. stocks, U.S. Bonds, and precious metals & their miners’ ETFs. The primary trends for gold & silver, SIL & GDX, and U.S. bond markets have not changed since I last reported. What is new since my last reporting is a nasty secondary reaction against the […]

Boosting the Dow Theory: Relative Strength System with Dow Theory for the 21st Century filter

posted on: April 4, 2022

What happens when one mixes a great timing indicator like the Dow Theory for the 21st Century (DT21C) with a relative strength system? Answer: Even more outperformance and a better risk-reward profile v. Buy and Hold (B&H). Relative Strength (RS) is based on the proven fact that assets (stocks, indexes, sectors, commodities, etc.) […]

Ten Thoughts on Trading/Investing

posted on: January 18, 2022

Ten Thoughts on Trading/Investing 1) Talking about the markets is fine and dandy. However, all investors need to know when to buy and when to sell. Even famed long-term investors sell. Buying without having an idea of the conditions that will trigger a sale is a recipe for disaster. 2) Technical Analysis […]

Dow Theory Update for December 21: Major drawdowns across major countries

posted on: December 21, 2021

From my Linkedin account A reminder of the destructive power of drawdowns. If you look at the book’s photo below, you’ll see that such devastating drawdowns over 20 years reflected a “conservative” 60/40 (60% stocks & 40% bonds) portfolio. As you are well aware, the Dow Theory may come in handy.As an aside, have […]

Dow Theory Update for October 6th: Primary bear market for US bonds signaled on October 5th

posted on: October 6, 2020

The primary trend remains bullish when one appraises the trend of US bonds with a somewhat longer time-frame. I still owe the readers of this Dow Theory blog the promised in-depth explanation of the current secondary reaction in SIL and GDX (the gold and silver miners ETFs). However, Dow Theory’s relevant events pile […]

Dow Theory Update for October 2: Why I favor using two alternative ways of appraising secondary reactions?

posted on: October 2, 2020

In-depth explanation about the current secondary reaction in precious metals coming soon In my last post, I summarily informed that the secondary trend for precious metals had turned bearish. However, I didn’t provide accurate calculations nor any charts. Since the appraisal of secondary reaction is vital for Dow Theorists, as we derive […]

Dow Theory Special Issue: On the Dow to Gold ratio

posted on: June 27, 2020

Is it a good timing device? Since this blog deals with US Stocks and Gold, and prompted by a Subscriber of thedowtheory.com, today I’ll briefly discuss the Dow to Gold ratio and its usefulness as a timing device. You can find an explanation of the Dow to Gold ratio and an excellent interactive chart displaying […]

Back To Top