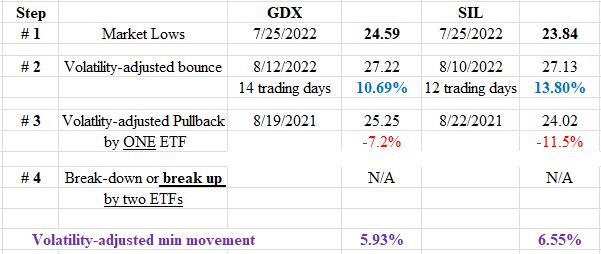

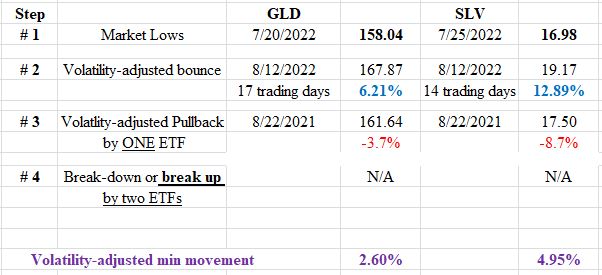

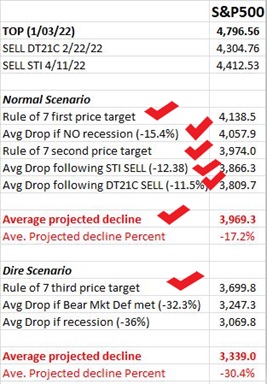

Dow Theory Update for August 25: Setup for a primary bull market completed for GDX and SIL (precious metals miners’ ETFs)

I am posting before the close so things might change. Readers beware. GOLD AND SILVER MINERS ETFs A) Market situation if one appraises secondary reactions not bound by the three weeks dogma. As I explained here, the primary trend was signaled as bearish on 6/23/22. Following the 7/25/22 closing lows for both GDX and for […]