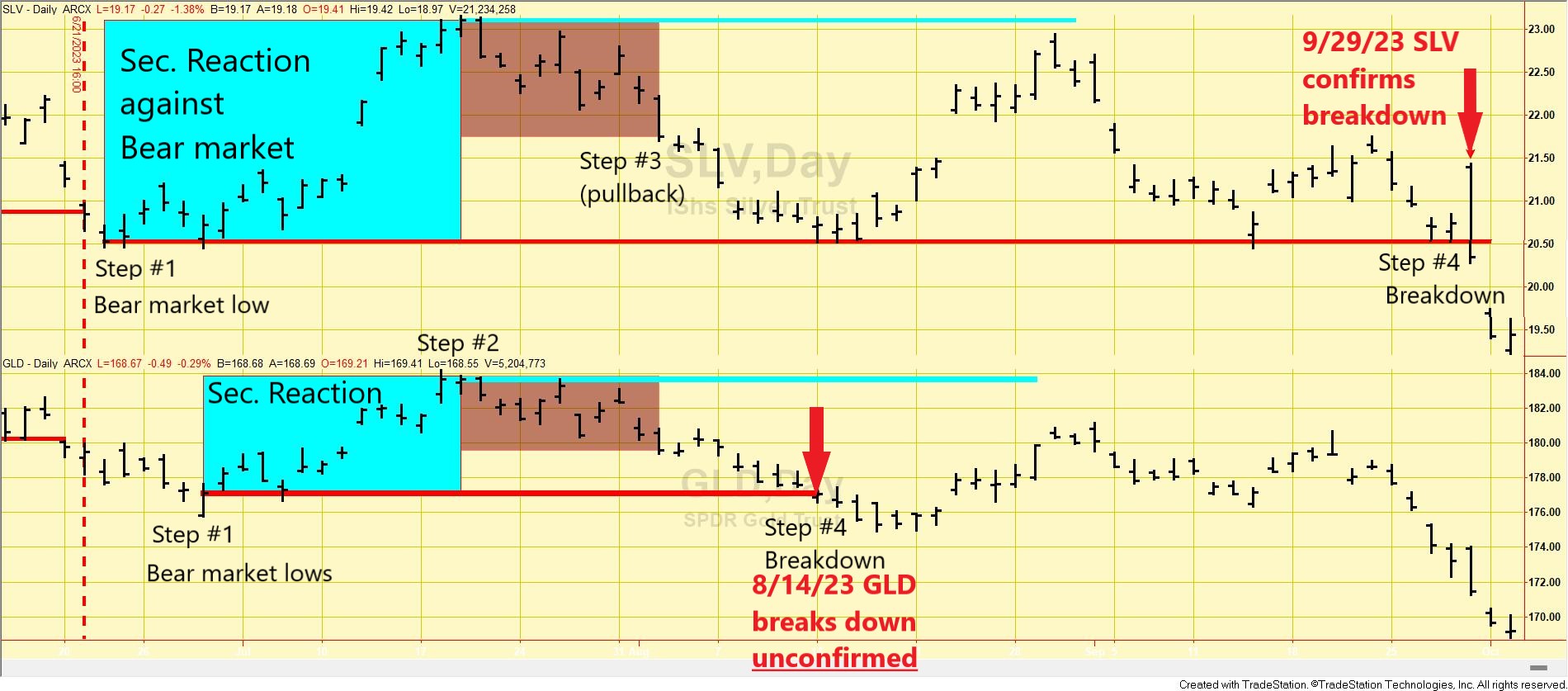

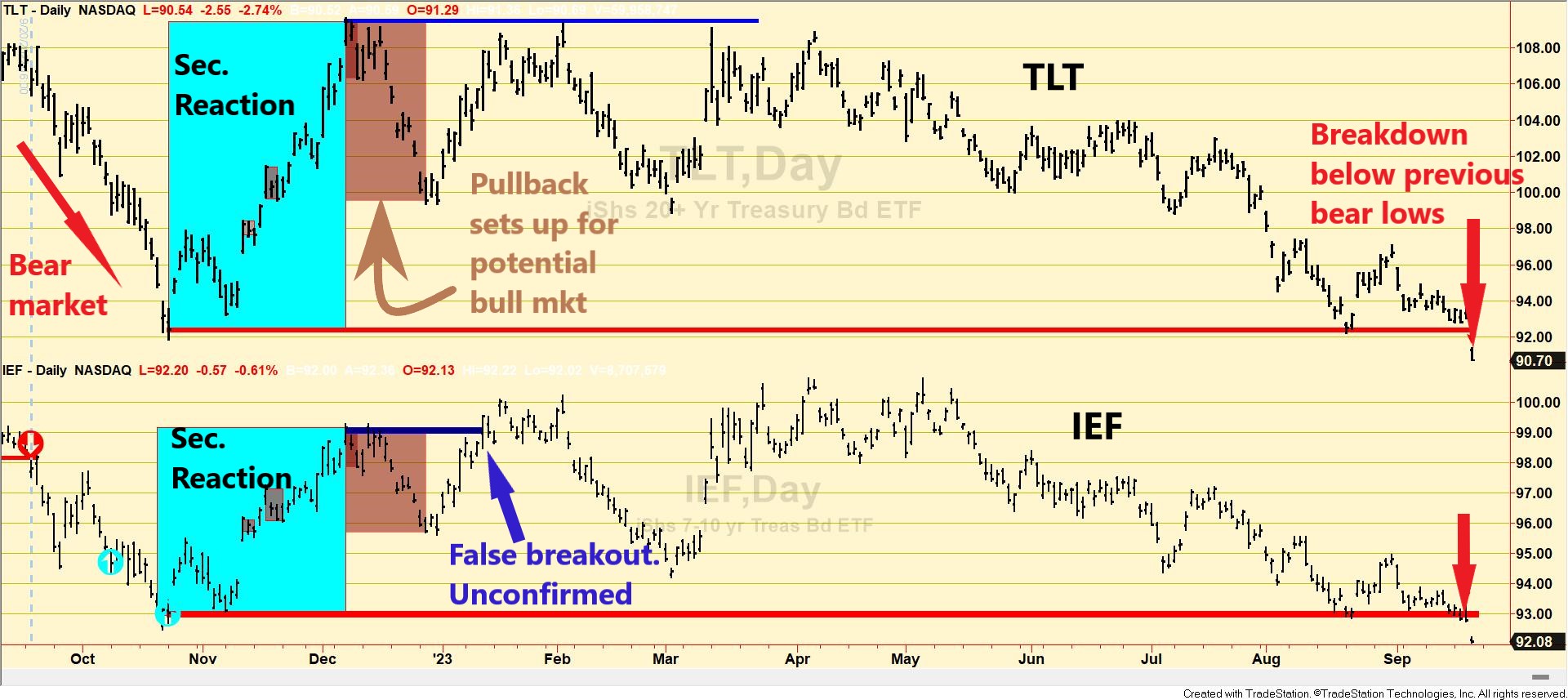

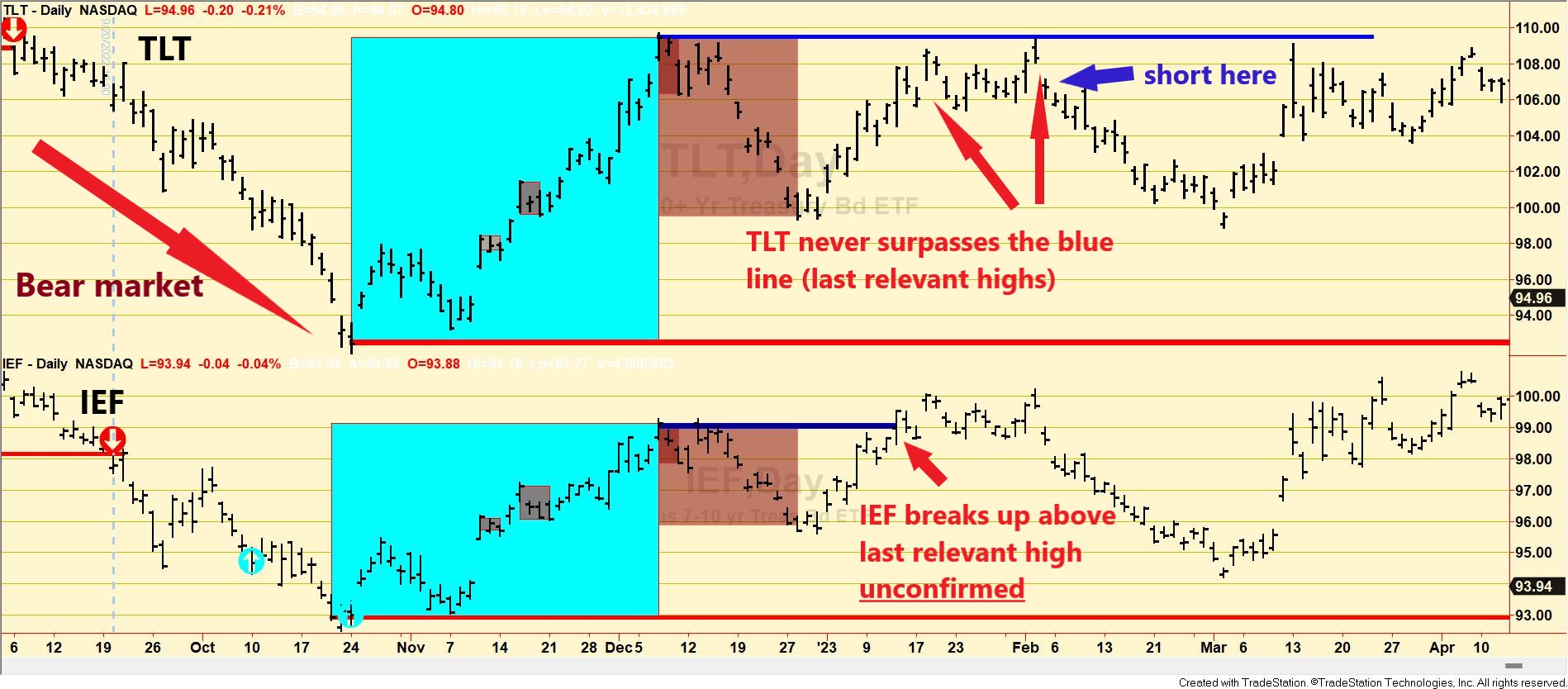

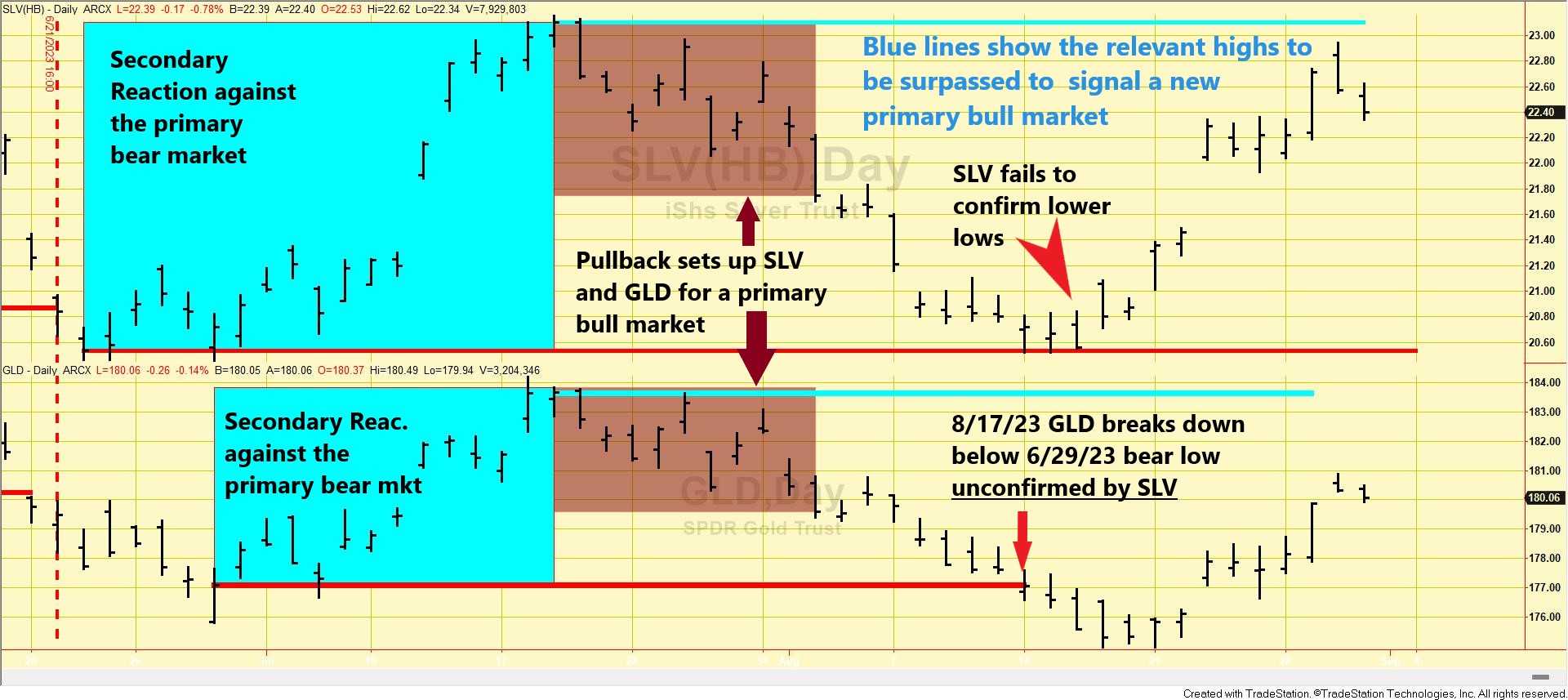

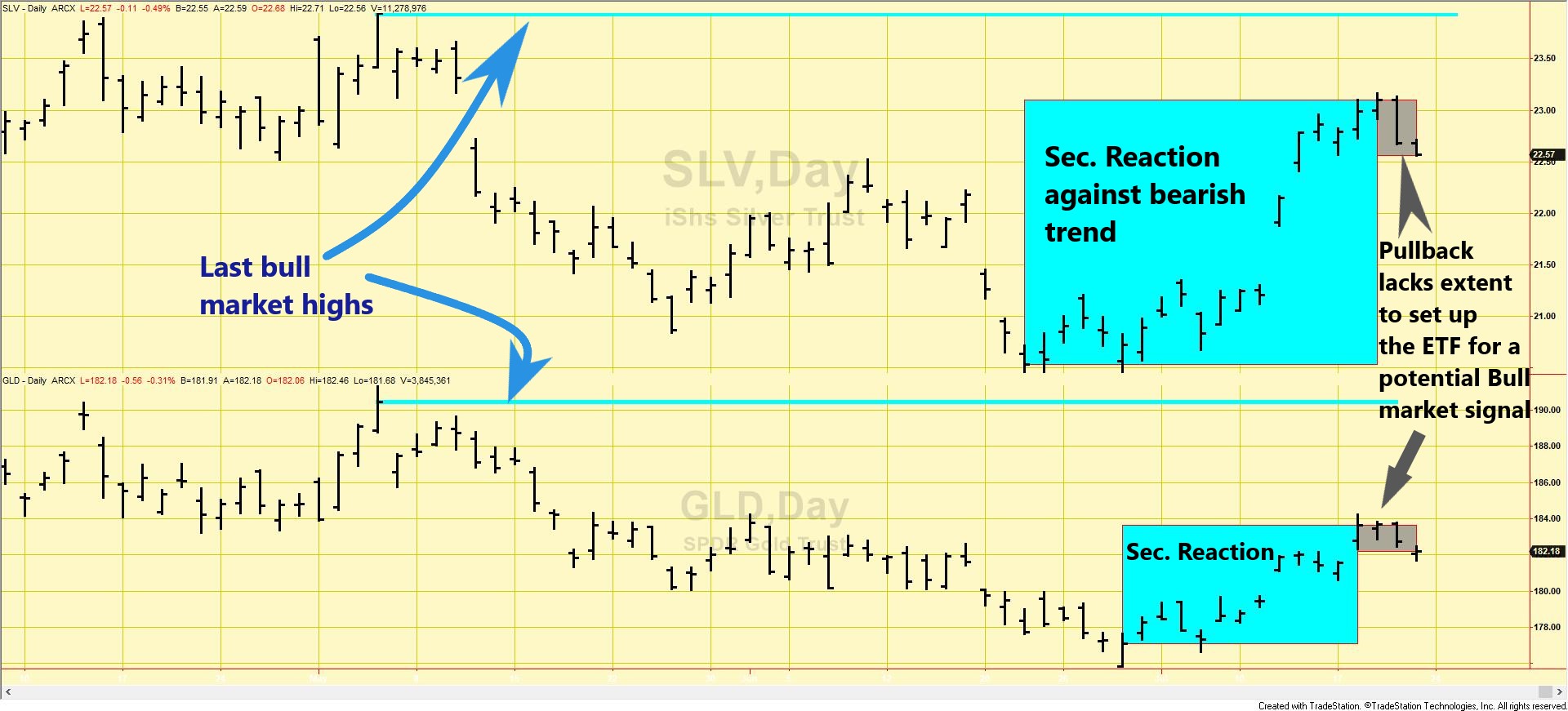

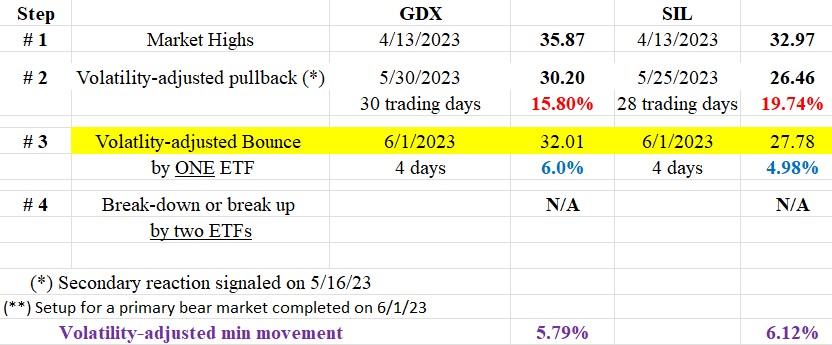

Dow Theory Update: The primary bear market in gold and silver reconfirmed on 9/29/2023

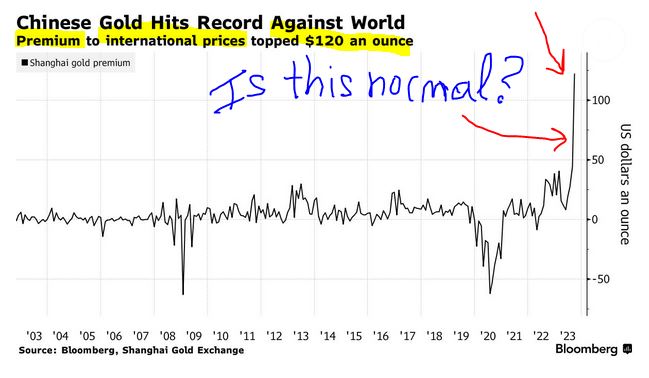

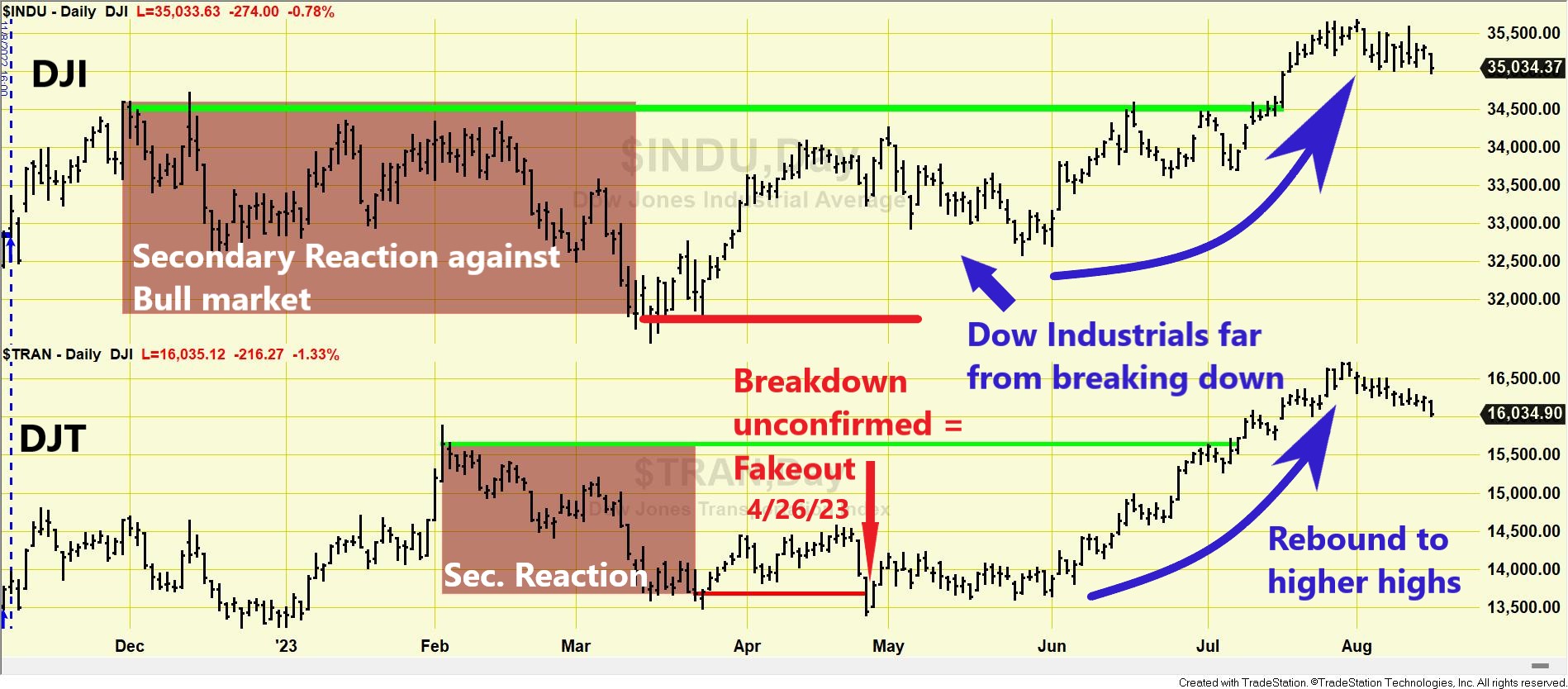

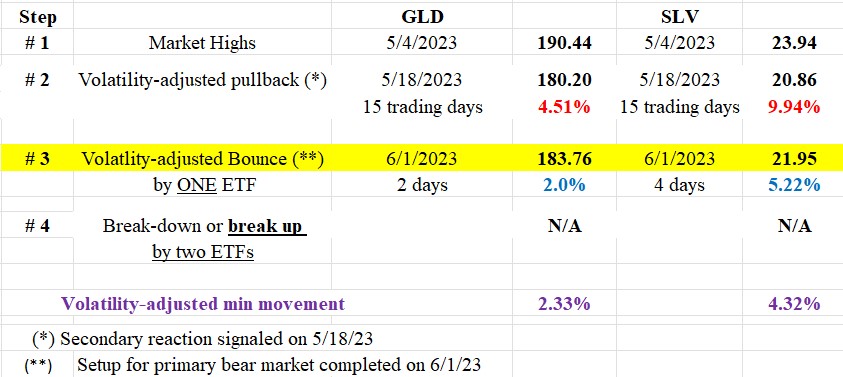

Gold and Silver miners ETFs (GLD & SIL) bearish trend unchanged General Remarks: In this post, I thoroughly explained the rationale behind using two alternative definitions to appraise secondary reactions. GOLD AND SILVER A) Market situation if one appraises secondary reactions not bound by the three weeks dogma. I explained HERE that gold and silver […]