Category: Precious Metals

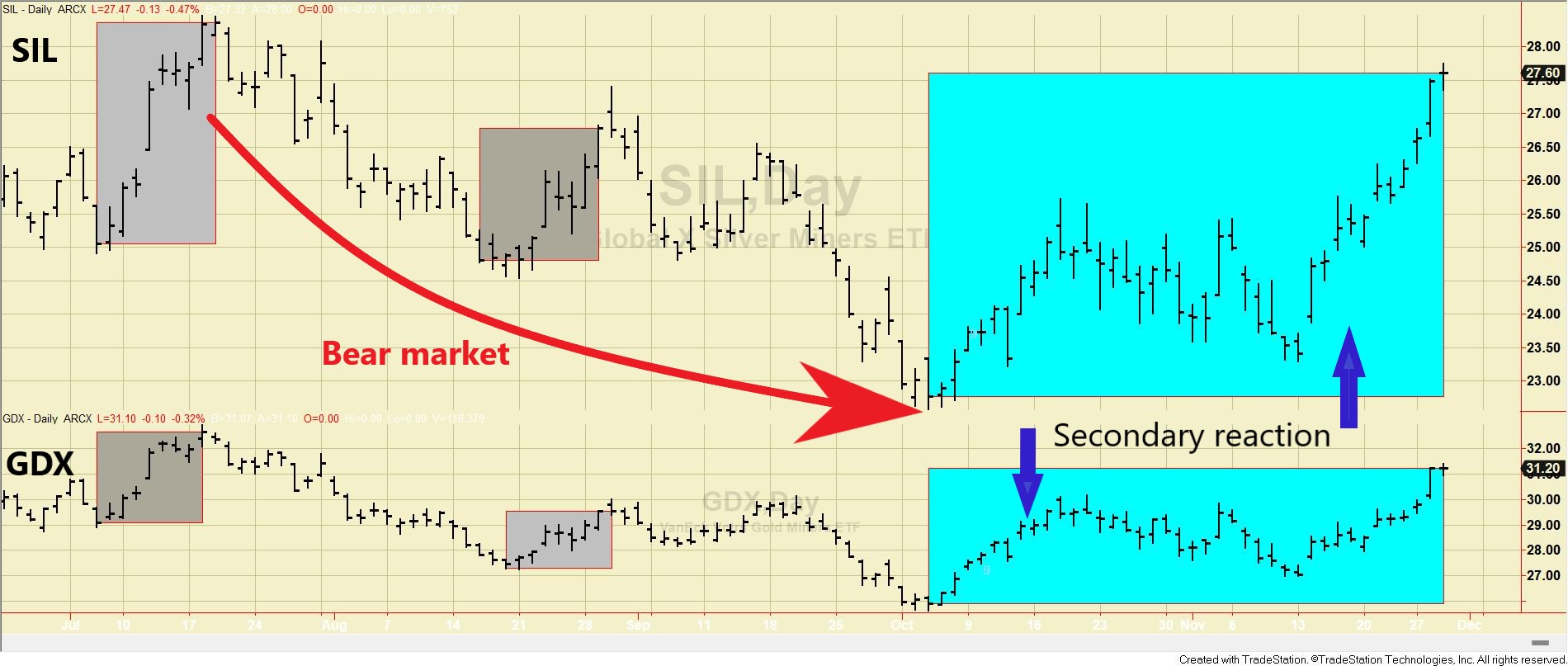

Dow Theory Update for November 30: Secondary reaction for SIL and GDX signaled on 11/28/23

posted on: November 30, 2023

General Remarks: In this post, I thoroughly explained the rationale behind using two alternative definitions to appraise secondary reactions. GOLD AND SILVER MINERS ETFs (GDX & SIL) A) Market situation if one appraises secondary reactions not bound by the three weeks dogma. The primary trend for GDX and SIL turned bearish on 6/20/23. You may […]

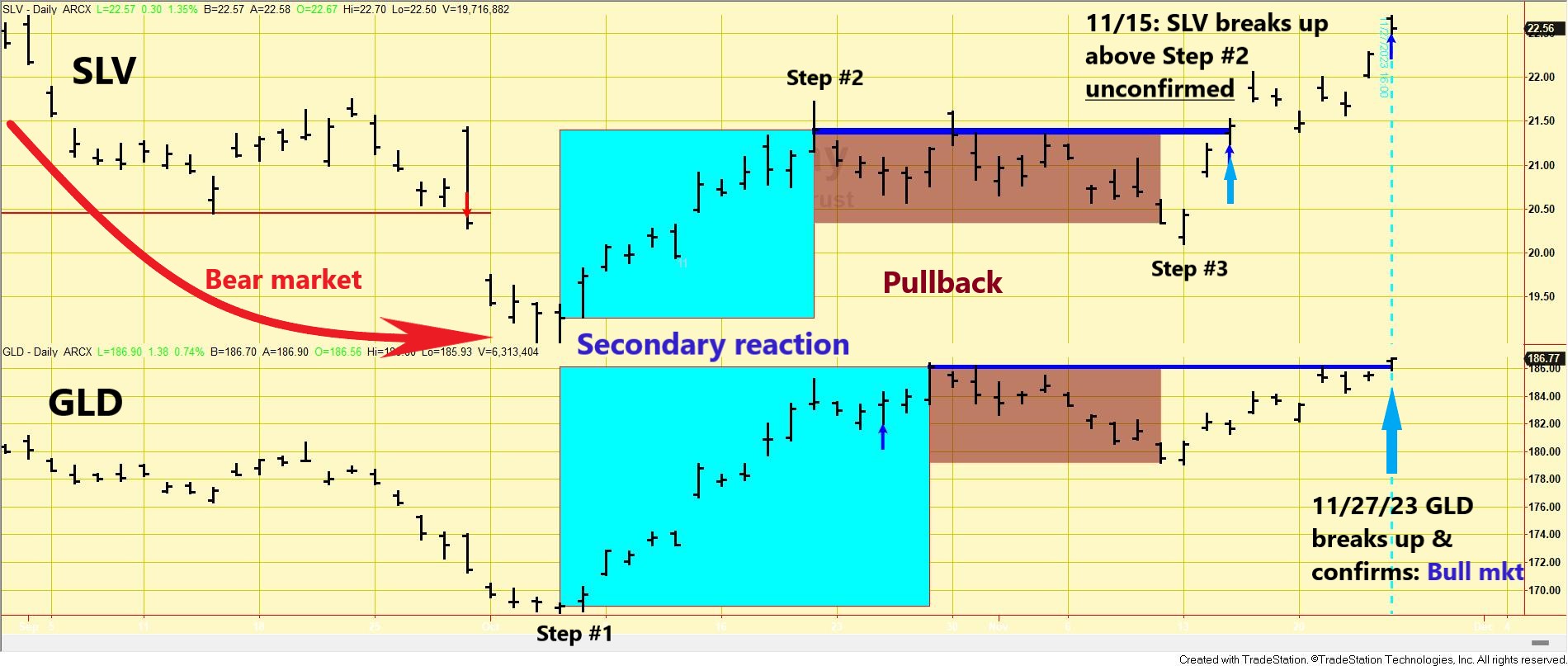

Primary bull market for gold and silver signaled on 11/27/23

posted on: November 27, 2023

General Remarks: In this post, I thoroughly explained the rationale behind using two alternative definitions to appraise secondary reactions. GOLD AND SILVER A) Market situation if one appraises secondary reactions not bound by the three weeks dogma. I explained HERE that gold and silver have been in a primary bear market since 6/21/23. Following a […]

Bull or Bear? Unveiling the Current State of Silver with YouTuber Alessio Rastani

posted on: November 13, 2023

In our latest episode, Alessio Rastani and I discuss the current state of the silver market. After rallying from its October lows, silver has experienced a recent pullback, prompting us to analyze whether the silver chart is currently exhibiting bullish or bearish signals. To watch the video, click on the image below.

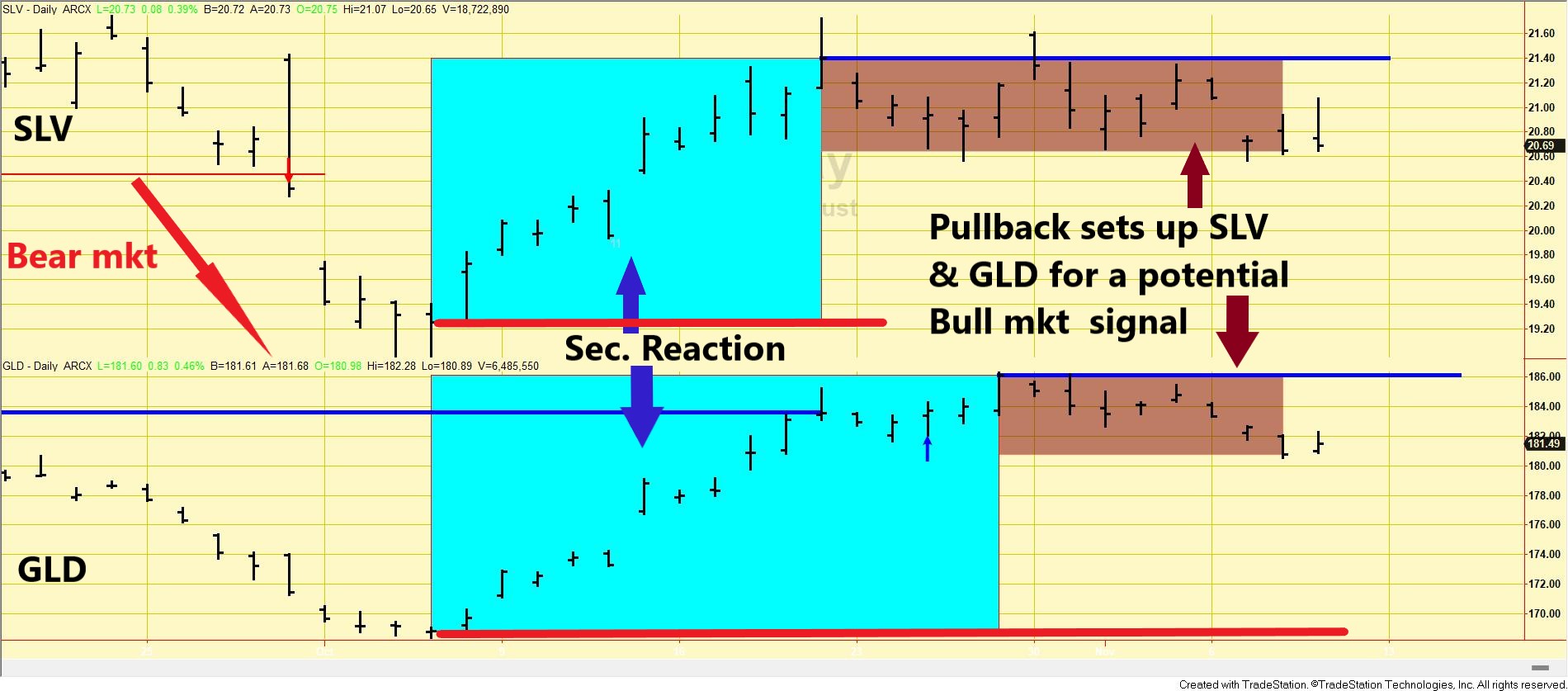

Dow Theory Update for November 11: Setup for a potential Bull market for SLV & GLD completed on November 8

posted on: November 9, 2023

General Remarks: In this post, I thoroughly explained the rationale behind using two alternative definitions to appraise secondary reactions. GOLD AND SILVER A) Market situation if one appraises secondary reactions not bound by the three weeks dogma. I explained HERE that gold and silver have been in a primary bear market since 6/21/23. After the […]

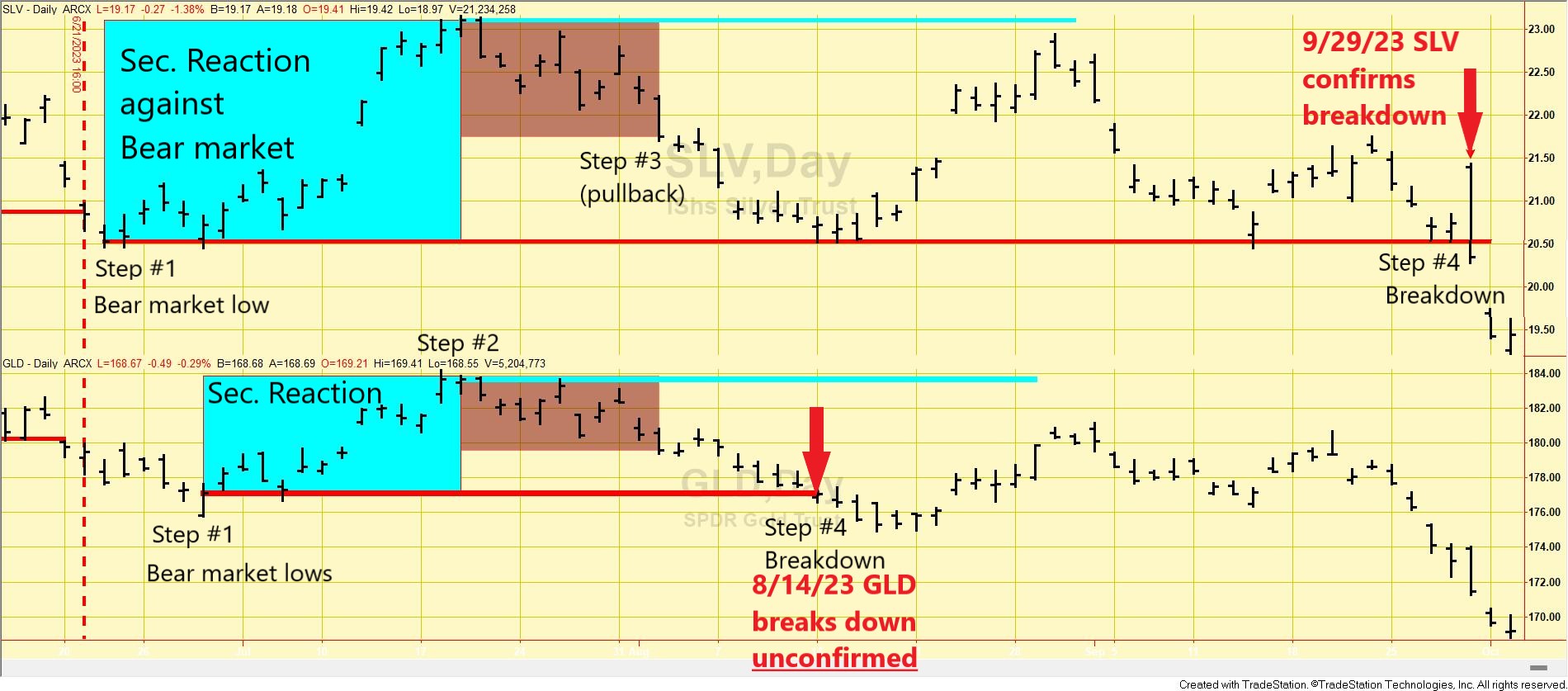

Dow Theory Update: The primary bear market in gold and silver reconfirmed on 9/29/2023

posted on: October 7, 2023

Gold and Silver miners ETFs (GLD & SIL) bearish trend unchanged General Remarks: In this post, I thoroughly explained the rationale behind using two alternative definitions to appraise secondary reactions. GOLD AND SILVER A) Market situation if one appraises secondary reactions not bound by the three weeks dogma. I explained HERE that gold and silver […]

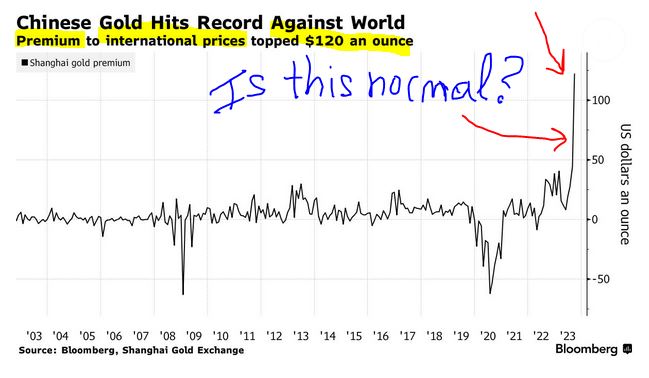

Dow Theory Update for September 19: No changes in trends but something is going on with gold

posted on: September 19, 2023

All the last updates I produced for gold/silver, GDX/SIL, and TLT/IEF and the U.S. stock market remain unchanged. Markets are like a coiled spring, and the final breakout will likely carry out significant follow-through. However, while markets remain range-bound, something is going on with physical gold. I recently found a Bloomberg article indicating that Shanghai’s […]

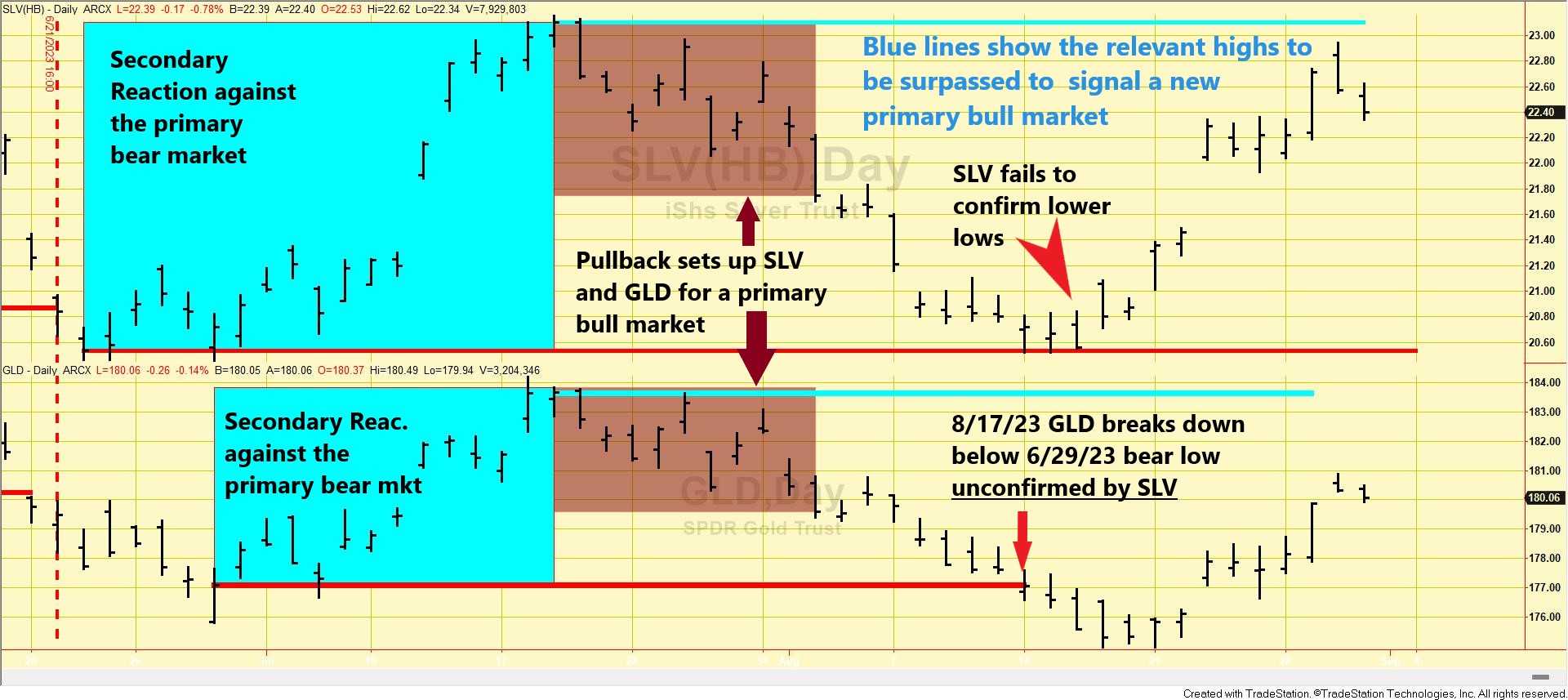

Dow Theory Update for August 31: Gold and Silver may trigger a new primary bull market soon

posted on: August 31, 2023

The setup for a primary bull market was completed on 8/2/23 General Remarks: In this post, I thoroughly explained the rationale behind my use of two alternative definitions to appraise secondary reactions. GOLD AND SILVER A) Market situation if one appraises secondary reactions not bound by the three weeks dogma. I explained HERE that gold […]

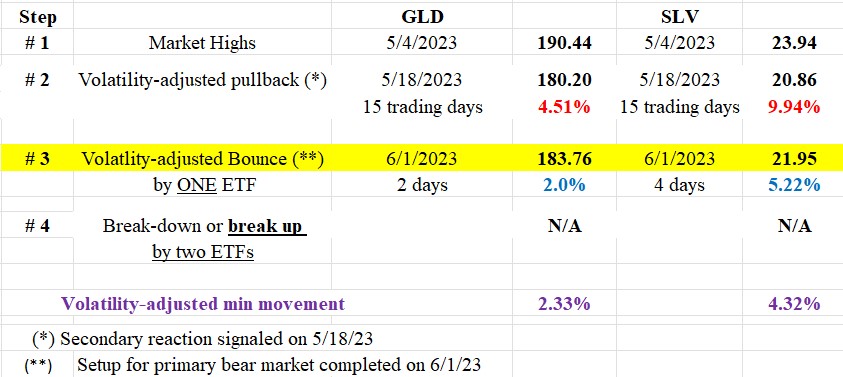

Dow Theory Update for June 3: Setup for a primary bear market signal for GLD and SLV completed on 6/1/23

posted on: June 9, 2023

I am writing before the close of 6/3/23. So readers, beware, things may change. Executive Summary: 1. The primary trend for gold and silver is bullish, the secondary one is bearish, and the setup for a potential primary bear market signal was completed on 6/1/23. The primary trend for gold and silver ETF miners (GDX […]

Dow Theory Update for December 1st: Primary bull market for gold and silver signaled on December 1st.

posted on: December 1, 2022

GDX and SIL in a primary bull market too A new primary bull market has been signaled in precious metals today (12/1/22). Yesterday, silver broke topside its secondary reaction highs. Today, gold confirmed, providing the awaited primary bull market signal. I hope to write soon a comprehensive article explaining the intricacies of this new […]

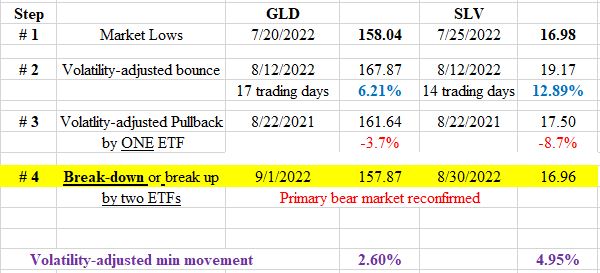

Dow Theory Update for September 5: Primary bear market for SLV and GLD reconfirmed on 9/1/22

posted on: September 5, 2022

GOLD AND SILVER A) Market situation if one appraises secondary reactions not bound by the three weeks dogma. As I explained here, the primary and secondary trend was signaled as bearish on 6/30/22. Following the 7/20/22 closing lows for GLD and 7/25/2022 for SLV, a secondary (bullish) reaction against the primary bear market developed. After […]

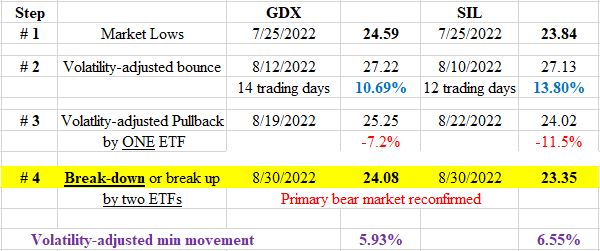

Dow Theory Update for September 3: Primary bear market for SIL and GDX reconfirmed on 8/30/22

posted on: September 3, 2022

Primary bear market for GLD and SLV reconfirmed on 9/1/22. Very soon, I will pen a new post concerning GLD and SLV. The overall picture for precious metals is bearish. I don’t want to give names, but when I signaled a primary bear market, I was criticized. The perma-bulls had an arsenal of reasons for […]

Dow Theory Update for August 25: Setup for a primary bull market completed for GDX and SIL (precious metals miners’ ETFs)

posted on: August 25, 2022

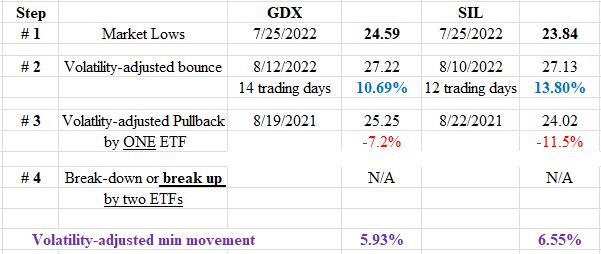

I am posting before the close so things might change. Readers beware. GOLD AND SILVER MINERS ETFs A) Market situation if one appraises secondary reactions not bound by the three weeks dogma. As I explained here, the primary trend was signaled as bearish on 6/23/22. Following the 7/25/22 closing lows for both GDX and for […]

Back To Top