Reminder: The Dow Theory for the 21st Century provides even more precise timing for the stock market

I will explain the latest “classical” Dow Theory buy signal in this post.

I must state that I don’t trade this kind of Dow Theory, despite its good record of outperformance and drawdown reduction vs. Buy and Hold. Why? A much-improved version of the Dow Theory named the Dow Theory for the 21st Century (DT21C), was created two decades ago by Jack Schannep and delivers even greater outperformance and drawdown reduction. The DT21C has a record starting in 1953 and has been traded in real portfolios since its creation. So, we are talking of a real improvement over the original Dow Theory that has successfully been traded in the markets for many years. For example, the Dow Theory for the 21st Century signaled a BUY much earlier, capturing substantial gains along the way. You can read more about the net superiority of the DT21C vs. the Dow Theory in this article.

You can find the original Dow Theory record in these links and compare it with the DT21C record.

https://thedowtheory.com/resources/traditional-dow-theory/complete-dow-theory-record/

https://thedowtheory.com/indicators/dow-theory-for-the-21st-century/

That being said, keeping an eye on the classical Dow Theory is good. While inferior to the DT21C, it is still much better than most trend-following systems out there.

So, let’s examine the latest Dow Theory signal.

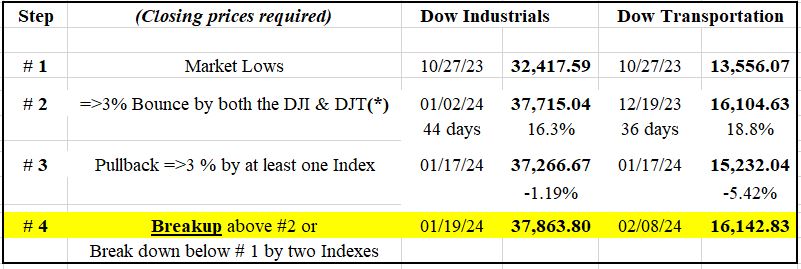

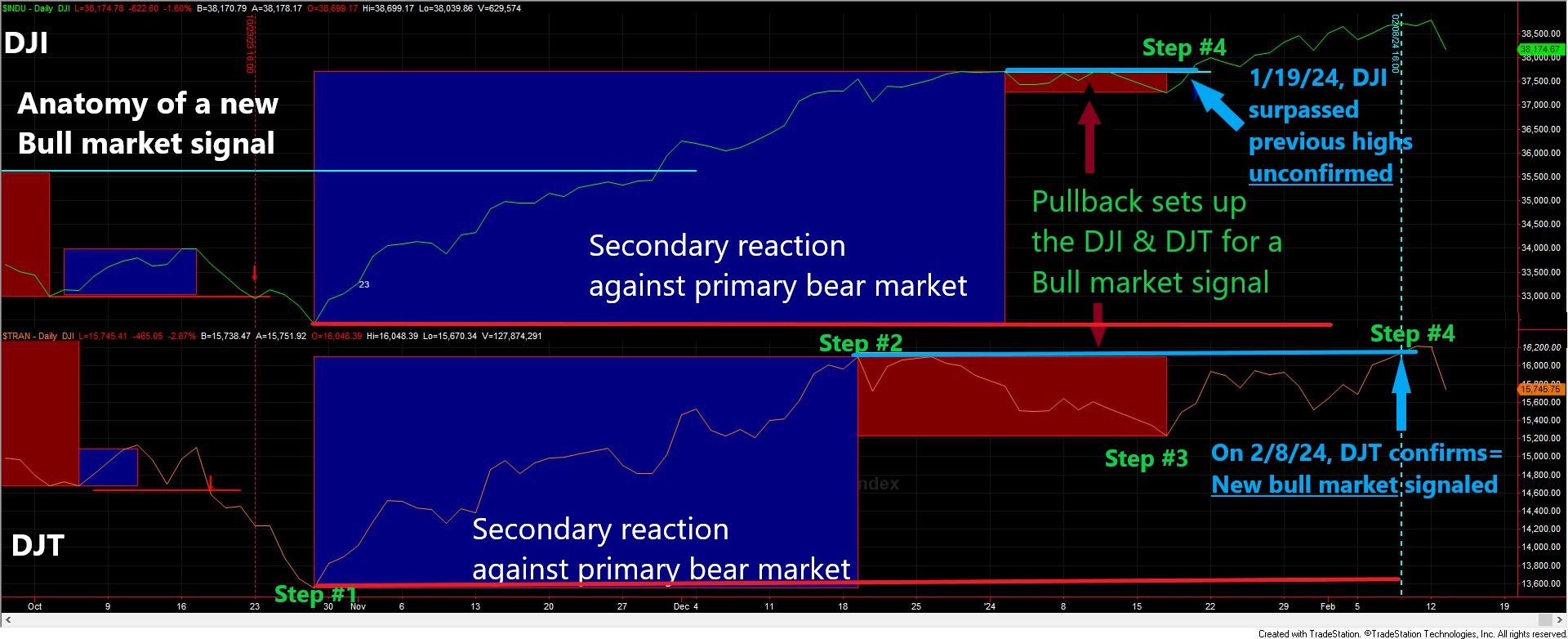

The primary trend turned bearish after the 8/1/23 and 7/28/23 top (Dow Industrials and Transportation, respectively). Following the 10/3/23 and 10/5/23 lows top (Dow Industrials and Transportation, respectively), there was a bounce until 1/2/24 and 12/19/23 (Dow Industrials and Transportation, respectively), thus lasting 44 trading days for the Industrials and 36 days for the Transportation. The pullback that set up both Indexes for a primary bull market signal lasted until 1/17/24. On 1/19/24, the Dow Industrials surpassed its 1/2/24 highs unconfirmed by the Transportation.

The Dow Theory is based on the principle of confirmation. As Robert Rhea put it, the movement of one index unconfirmed by the other is likely deceptive. Hence, if one index is trending up but the other is either going down or not going up enough to surpass previous highs, this lack of confirmation negates any new bull market.

Finally, on 2/8/24, the Dow Transportation broke above its 12/19/23 closing highs, confirming the Dow Industrials and triggering the new primary bull market signal.

However, Dow Theorist Rhea also wrote that belated confirmations carry less weight than earlier ones. So, I feel that this new bull market signal is a “weak” one and I would not be surprised to see weakness in the next two months.

Confirming technical weakness, the inflation report for January, published on 2/13/24, which exceeded expectations, caused a tumult in financial markets and disrupted investors’ predictions regarding the timing and magnitude of potential interest rate cuts by the Federal Reserve. The market was priced to perfection, and higher-for-longer interest rates may cause a painful correction in the stock market. However, we should not underestimate the power of the primary trend. Now, it is unambiguously bullish, so I don’t expect a bear market, but just a correction that may last a couple of months.

The table below give you all the relevant dates and prices:

Once in a bullish phase, our focus shifts to monitoring price levels that could indicate the start of a new primary bear market. At the time of writing, a joint penetration of the 10/27/23 market lows (Step #1 in the above Table) would change the primary trend from bullish to bearish. While this outcome seems unlikely at present, it warrants continuous observation. The more probable scenario is that following the current highs (or potential higher highs), a pullback will occur, with these pullback lows serving as the next stop-loss level. However, it’s important not to rush and exercise patience, allowing price action to guide us in determining the next stop-loss level.

The charts below depict the latest price movements. The upper chart illustrates the Dow Industrials, while the lower one represents the Dow Transportation. Highlighted by blue rectangles are the secondary reactions (bounces), while the red ones indicate pullbacks that positioned both indexes for a potential primary bull market signal. The blue horizontal lines mark the bounce highs (Step #2) of DJI and DJT, representing crucial price levels whose breach was necessary to signal a new primary bull market. The blue arrows indicate when DJI and DJT surpassed their respective bounce highs. Conversely, the red horizontal lines denote the most recent primary bear market lows, the breakdown of which would signal a primary bear market (an unlikely scenario at present).

Ever wondered about the effectiveness of the Dow Theory in the 21st century? It’s a powerful tool, and here’s the inside scoop: we’ve kept it exclusive to our subscribers. By staying ahead with the DT21C, they’ve been riding the bull market long before others caught on. But that’s not all. Subscribers also gain access to our Composite Indicator, a fusion of DT21C and the Blay Timing Indicator. Our model portfolio, guided by this Composite Indicator, defied naysayers in 2023 (and in 2020, December 2018, 2009, 2002, etc.), staying invested and delivering a remarkable profit of over +17%. If you’re serious about staying ahead in the market and minimizing your risks, it’s time to consider subscribing. Join us now and start maximizing your returns while reducing drawdowns. Take action and subscribe today!

https://thedowtheory.com/sign-up/

Sincerely,

Manuel Blay

Editor of thedowtheory.com