Analyzing the Impact of Powell’s Hawkish Stance on GDX and SIL

Overview: All markets, gold and silver miners included, reacted negatively to Powell’s more hawkish stance, as investors had anticipated more substantial and frequent rate cuts. The big drop GDX and SIL experienced on 12/18/24 triggered a primary bear market signal.

The precious metals themselves, gold and silver, are not in a Bear market, as SLV’s lower lows were not confirmed by GLD, which displayed good relative strength. However, if GLD pierced on a closing basis, its 11/15/24 secondary reaction low at 236.59, a primary bear market would be signaled. So, the primary trend remains bullish, and the secondary one is bearish, as explained HERE.

General Remarks:

In this post, I extensively elaborate on the rationale behind employing two alternative definitions to evaluate secondary reactions.

SIL refers to the Silver Miners ETF. More information about SIL can be found HERE.

GDX refers to the Gold Miners ETF. More information about GDX can be found HERE.

A) Market situation if one appraises secondary reactions not bound by the three weeks and 1/3 retracement dogma

As I explained in this post, the primary trend was signaled as bullish on 4/3/24.

My 11/19/24 post started to sound the alarms concerning a possible bear market signal on the horizon.

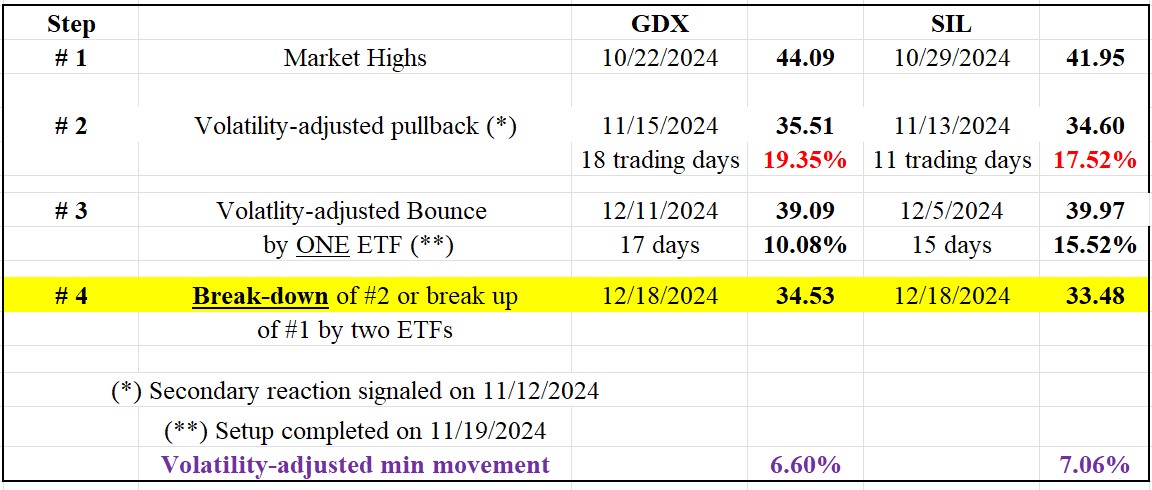

On 12/18/24, GDX and SIL jointly pierced their respective secondary reaction lows (11/13/24 for SIL and 11/15/24 for GDX), as shown in Step #2 in the table below. Such a confirmed breakdown shifted the trend from bullish to bearish.

So, the primary and secondary trends are bearish now.

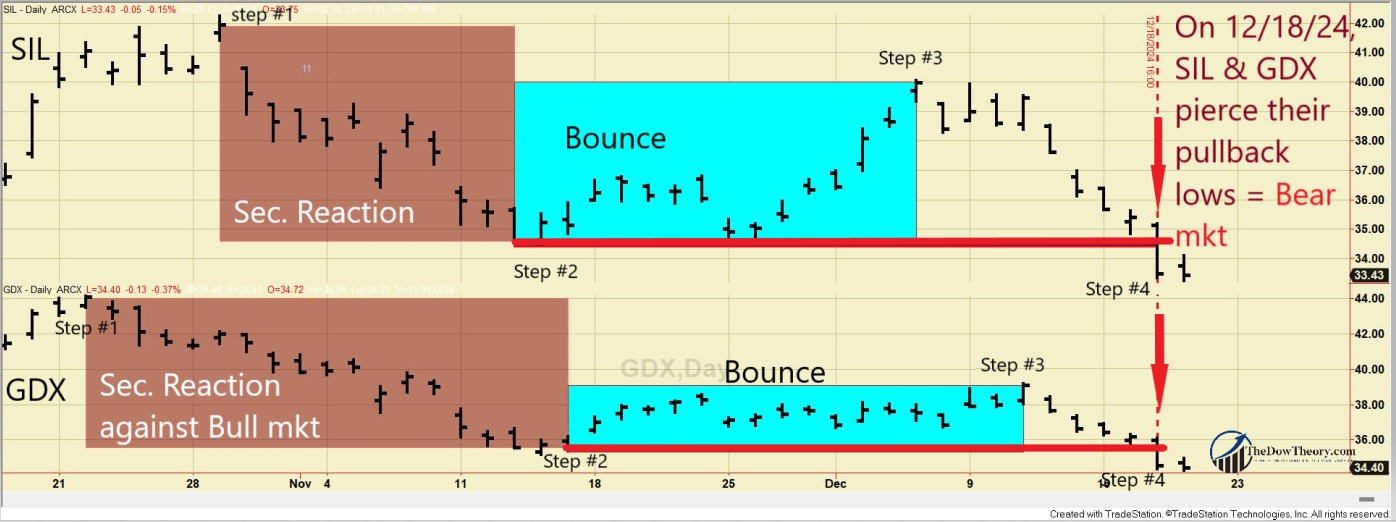

The following charts depict the latest price movements. Brown rectangles indicate the secondary (bearish) reaction opposing the ongoing primary bull market. Blue rectangles highlight the recent rally that fulfilled the setup for a potential primary bear market (Step #3). Red horizontal lines mark the secondary reaction lows (Step #2). The blue horizontal lines show the bounce highs (Step #3), which independently also satisfy the time and extent requirement for a secondary reaction. A breach of these peaks would signal a new primary bull market, though this scenario appears unlikely in the near term.

So, the situation is as follows: At the current juncture, a breakup on a closing basis by both GDX and SIL of the 12/6/24 closing highs (Step #3) would signal a new bull market. Until this breakup occurs, we consider bonds in a bear market.

B) Market situation if one sticks to the traditional interpretation demanding more than three weeks and 1/3 confirmed retracement to declare a secondary reaction.

As I explained in this post, the primary trend was signaled as bullish on 7/31/24.

My 11/29/24 post started to sound the alarms concerning a possible bear market signal on the horizon.

In this instance, the long-term application of the Dow Theory coincides with the shorter-term version, so a primary bear market signal has been triggered on 12/18/24.

Sincerely,

Manuel Blay

Editor of thedowtheory.com