Secondary Reaction Highs (Lows): The Key to Market Confirmation

Recent weakness in the Dow Jones Transportation Average relative to the Dow Jones Industrial Average has prompted many “experts” to proclaim a bear market signal. They argue that new all-time highs by the Dow Industrials, unconfirmed by the Dow Transports, spell doom for the overall stock market.

Understanding the Dow Theory

Let’s clarify the concepts. Lack of confirmation means that one index makes a higher high (or lower low), and the other fails to break out. However, there is a common misconception about the Dow Theory. It’s often believed that if one index makes an all-time high, the other must also make an all-time high to confirm. This is not the case.

The Dow Theory, a cornerstone of stock market analysis, is based on the concept of secondary reactions. The top (or bottom) of a secondary reaction, which need not be an all-time high, is the relevant price level to be taken out. Thus, it can well happen that one index, like the Dow Industrials, makes an all-time high while the other takes out a minor high (a secondary reaction high). This counts as confirmation.

The Importance of Relevant Highs

Fixating on both indexes surpassing their all-time highs is not the right way to apply the Dow Theory. Most signals would be terribly late if we demanded “all-time highs” confirmation. Jack Schannep explains it beautifully on pages 39-41 of his book.

This post also gives a recent example of the relevant highs to focus on in seeking confirmation. While significant weakness in the Dow Transports when both the S&P 500 and Dow Industrials are making higher highs may be a yellow flag (as it was in October 2007 and December 1999), requiring all-time highs confirmation to enter the market leads to poor performance.

Thus, the lack of confirmation of a relevant high (not “all-time highs”) merely serves as a yellow light that may question the persistence of the current trend. It is NOT, as many purport, a signal showing a change in the trend.

Bullish Implications of Non-Confirmation

Furthermore, I will boldly assert that the Dow Transports’ lack of confirmation of an all-time high by the Dow Industrials is bullish. This is not just a claim, but a viewpoint supported by two studies.

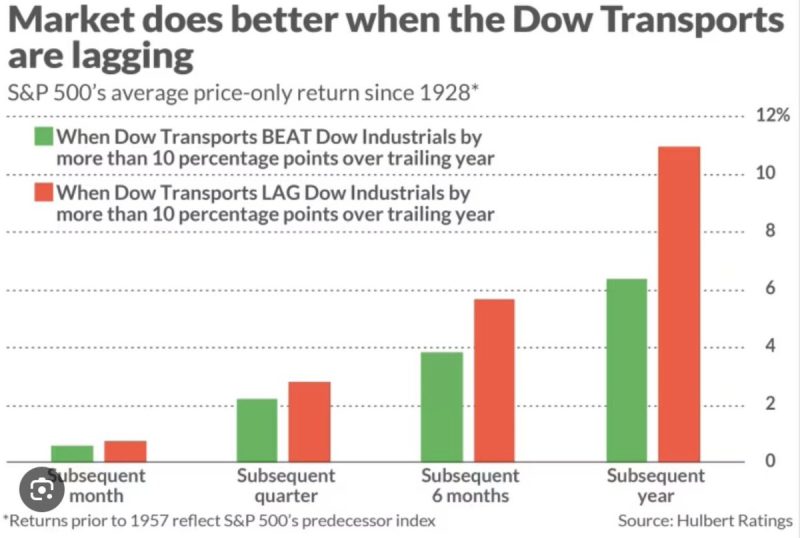

The first study by Mark Hulbert shows that the stock market performs better when the Dow Transports are lagging.

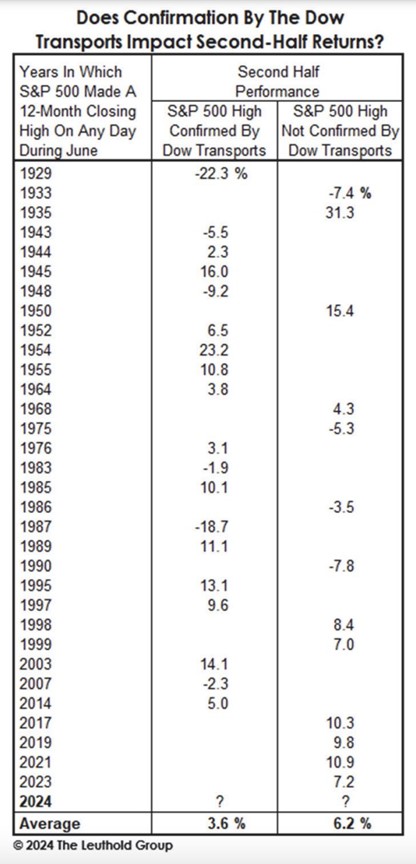

The second study by Seth Golden shows that while the S&P 500 made a new 12-month high in the first half of the year unconfirmed by Dow Transports, it was notably higher in the second half of the year. The study confirms that “all-time” or “12-month highs” confirmations are not the proper highs to focus on when looking for confirmation.

Key Takeaways

Confirmation is essential when correctly applied: Focus on the highs (or lows) of secondary reactions, which in many instances are not the all-time highs. Lack of confirmation of such relative highs is a yellow flag (not a red one) with trading implications as they help avoid a sucker rally or a bear trap, as you can see in the following examples HERE and HERE, and a couple of weeks ago with Bitcoin whose breakup was not confirmed by Ethereum (a post on this non-confirmation that once again saved my skin will follow soon).

Conclusions

- When applying the principle of confirmation, identify the right highs (or lows) to be jointly taken out.

- All-time highs are not the right highs in many instances.

- Secondary reaction highs (or lows) are the right highs (or lows) to focus on in most cases.

- Lack of confirmation of a relevant high (or low) is not a Sell (or Buy) signal; it is simply a yellow flag.

- Lack of confirmation by the Dow Transports of an all-time high or even a 12-month high is actually bullish for the stock market.

Sincerely,

Manuel Blay

Editor of thedowtheory.com