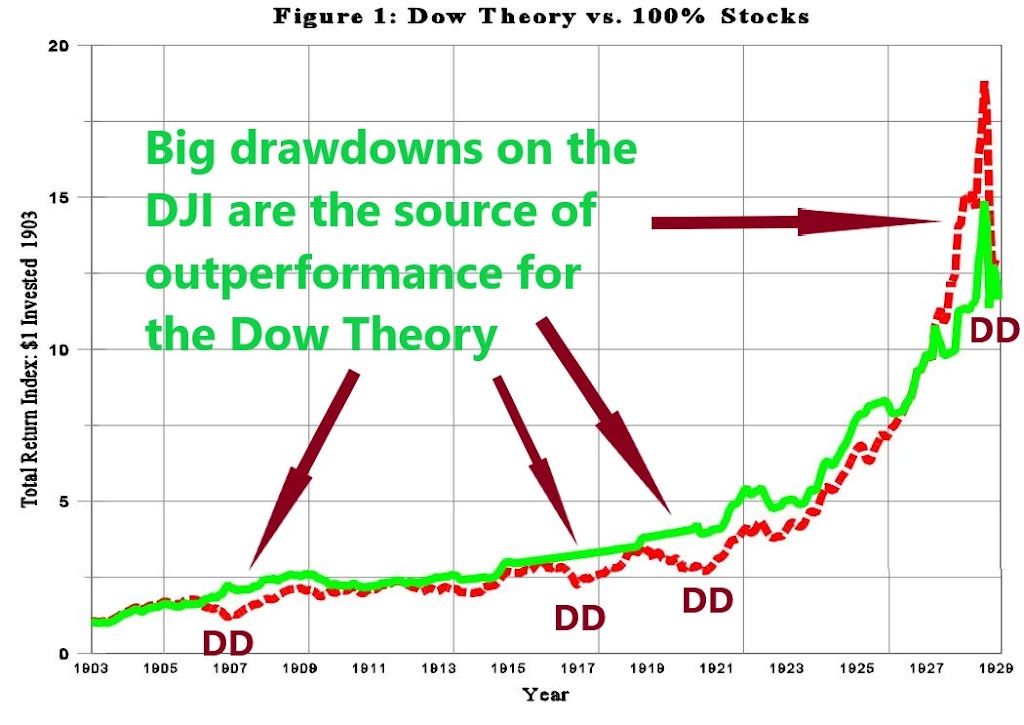

Dow Theory Update for September 19: Halmiton’s market calls (1900-1929) revisited

Does the classical Dow Theory yield positive risk-adjusted returns? The answer is: YES. The article linked below penned by William Goetzmann proves that the market calls made by Dow Theorist Hamilton from 1902 to 1929 beat buy and hold on a risk-adjusted basis. https://citeseerx.ist.psu.edu/viewdoc/download;jsessionid=9D2DF4DC55D81DA9EEFADA02B019F9F2?doi=10.1.1.199.1866&rep=rep1&type=pdf The edited chart below extracted from the linked […]