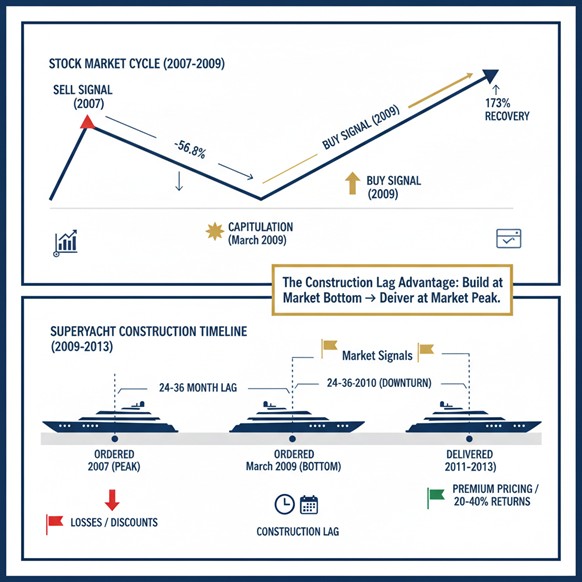

Strategic Market Timing for Luxury Superyacht Construction

Super Yacht Builders’ Guide to Counter-Cyclical Growth By George Morton, PhD, January 2026 Executive Summary Dow Theorist Hamilton, in his 1922 book The Stock Market Barometer: A Study of Its Forecast Value, described the averages as a reliable barometer for forecasting trends in business activity (including industrial aspects). He emphasized its predictive power for economic/industrial […]