Category: Dow Theory and bonds

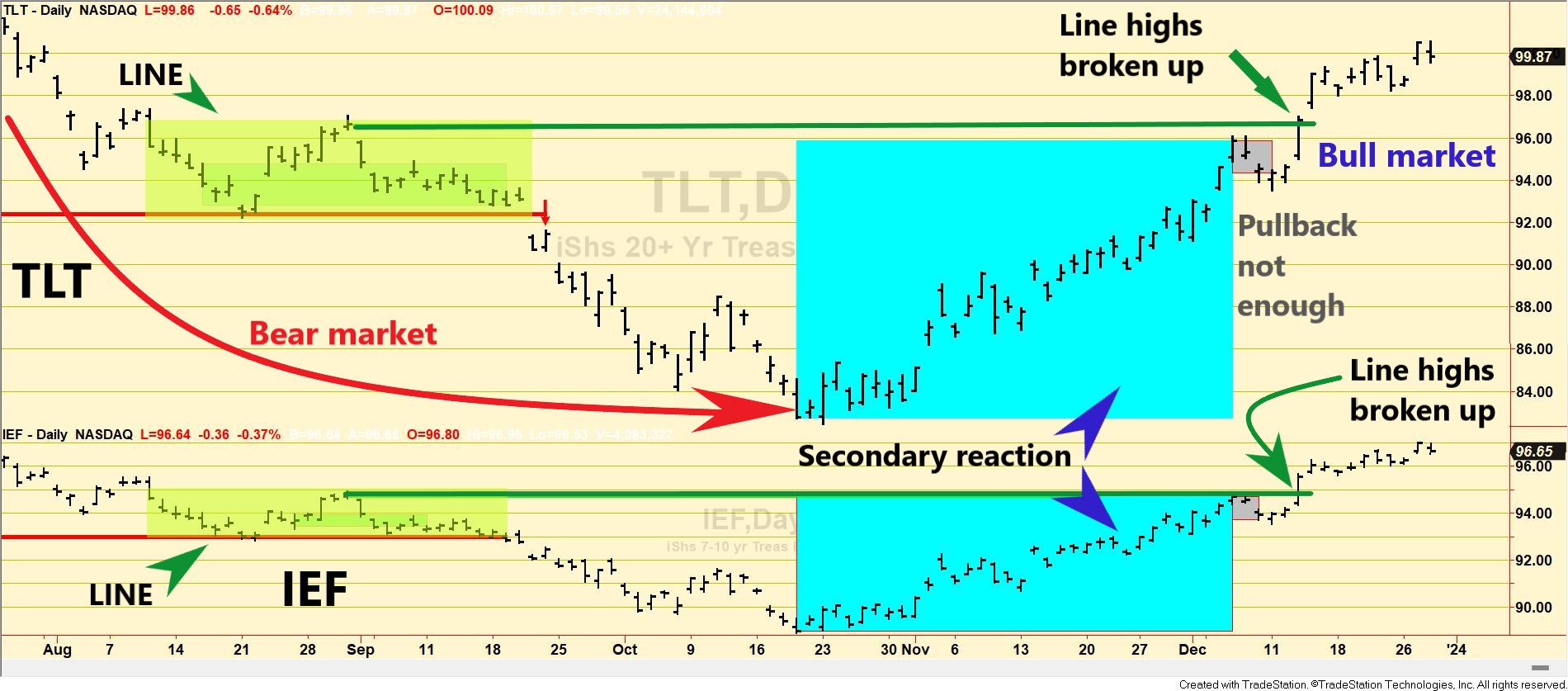

U.S. bonds are in a new primary bull market

posted on: December 29, 2023

This post was challenging to compose. Occasionally, trends don’t conform to a textbook pattern, requiring additional interpretation grounded in sound principles. It won’t be an easy read, but sometimes, sound analysis cannot be compressed into a couple of lines. General Remarks: In this post, I thoroughly explained the rationale behind using two alternative definitions to […]

Dow Theory Update for November 18: U.S. bonds under a secondary reaction against the still-existing bearish trend.

posted on: November 18, 2023

General Remarks: In this post, I thoroughly explained the rationale behind using two alternative definitions to appraise secondary reactions. TLT is the iShares 20 years + Treasury bond ETF. More about it here IEF is the iShares 7-10 years Treasury bond ETF. More about it here. Thus, TLT tracks longer-term US bonds, whereas IEF tracks […]

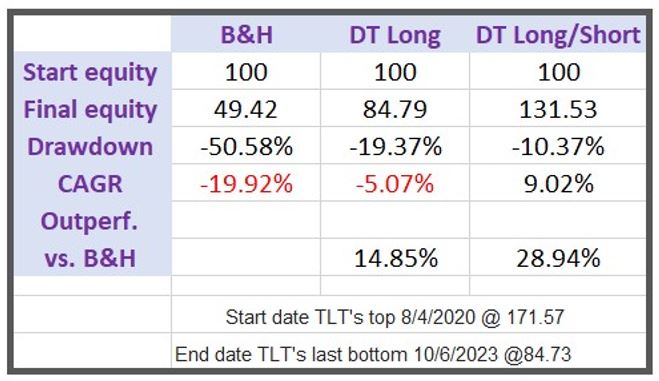

Bonds in Crisis: Discovering Dow Theory’s Healing Touch

posted on: October 12, 2023

Dow Theory’s Prescription for the Bond Debacle Dilemma Due to the surge in interest rates, long-duration bonds have experienced a significant loss of value, amounting to a 50% drawdown. This substantial decline in the so-called safe haven asset class resembles the drawdowns seen in stock indexes, underscoring the fact that unexpected events occur. Investors sometimes […]

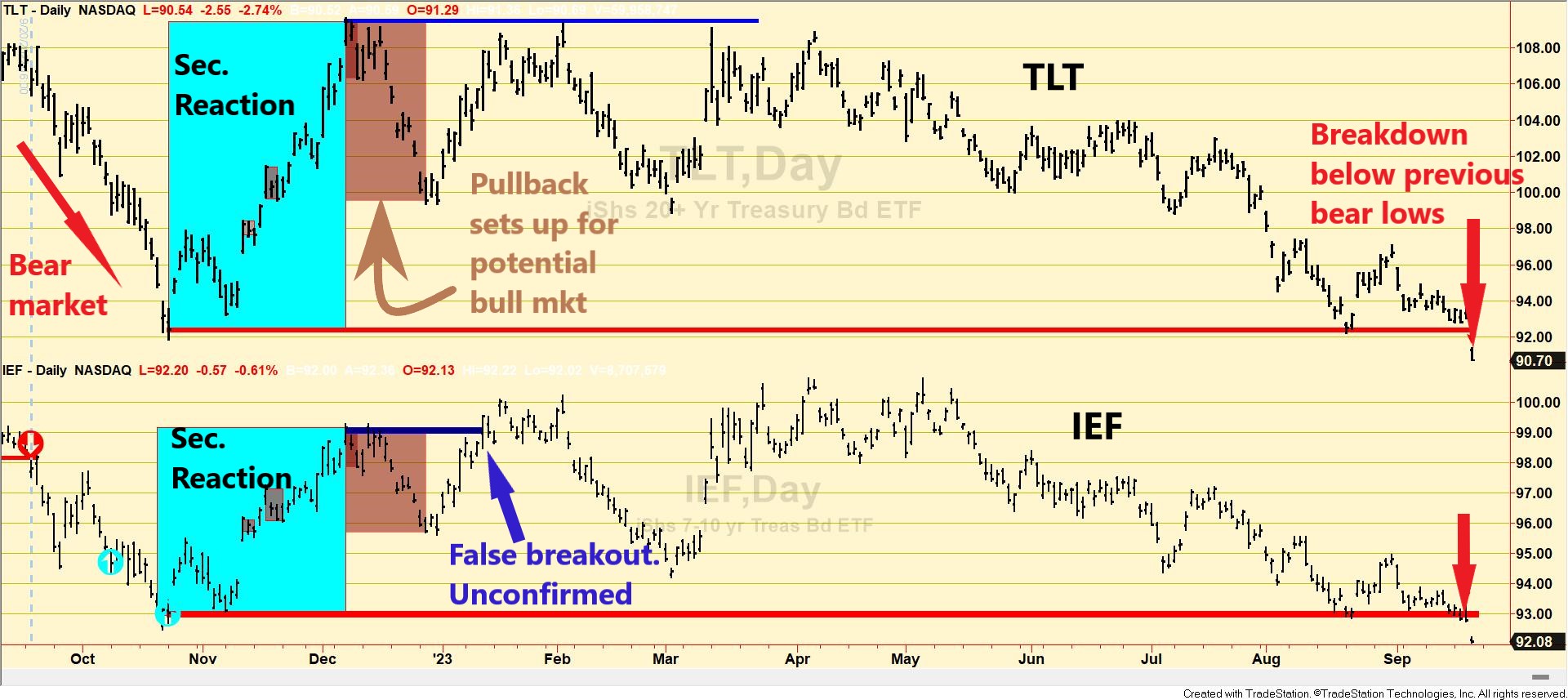

Dow Theory Update for September 21: Primary bear market in U.S. bonds reaffirmed on 9/21/23

posted on: September 21, 2023

The bear market in bonds continues… General Remarks: In this post, I thoroughly explained the rationale behind my use of two alternative definitions to appraise secondary reactions. TLT is the iShares 20 years + Treasury bond ETF. More about it here IEF is the iShares 7-10 years Treasury bond ETF. More about it here. Thus, […]

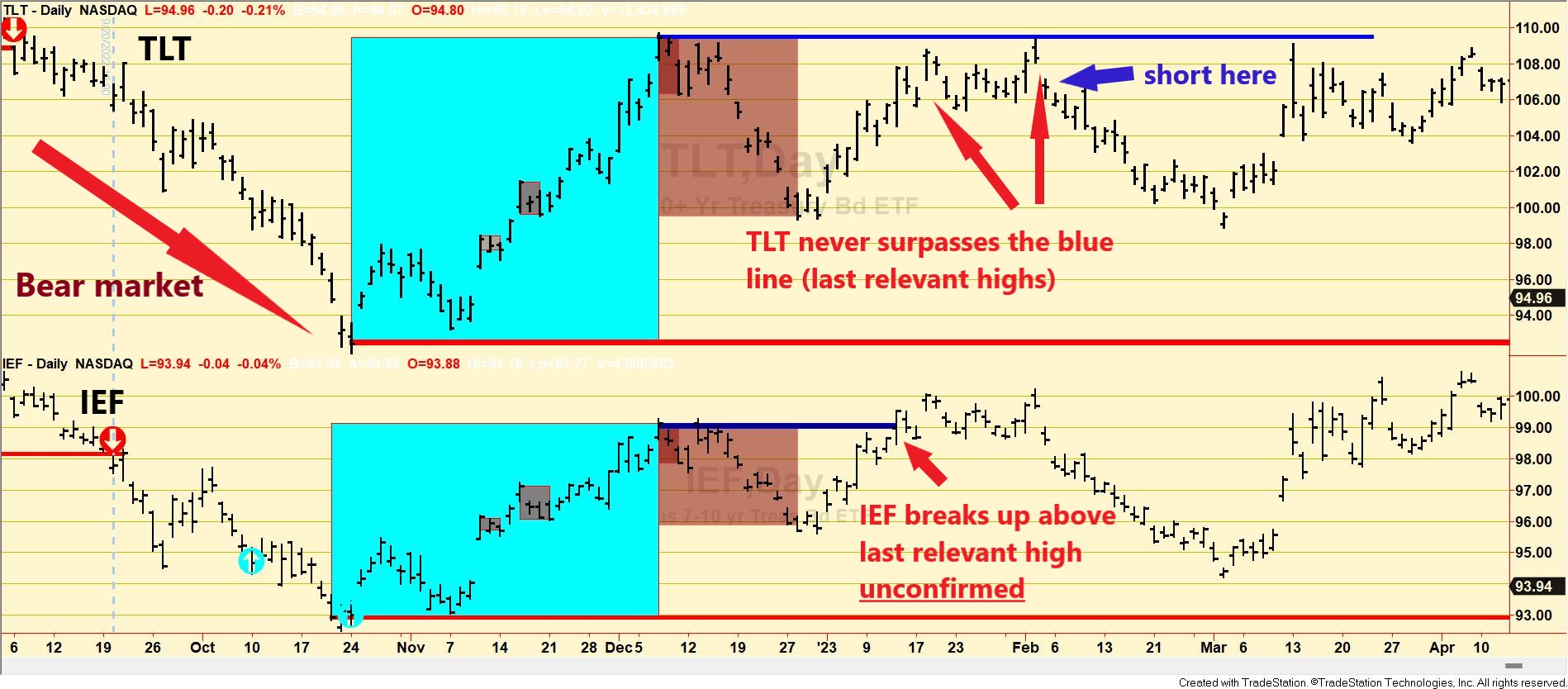

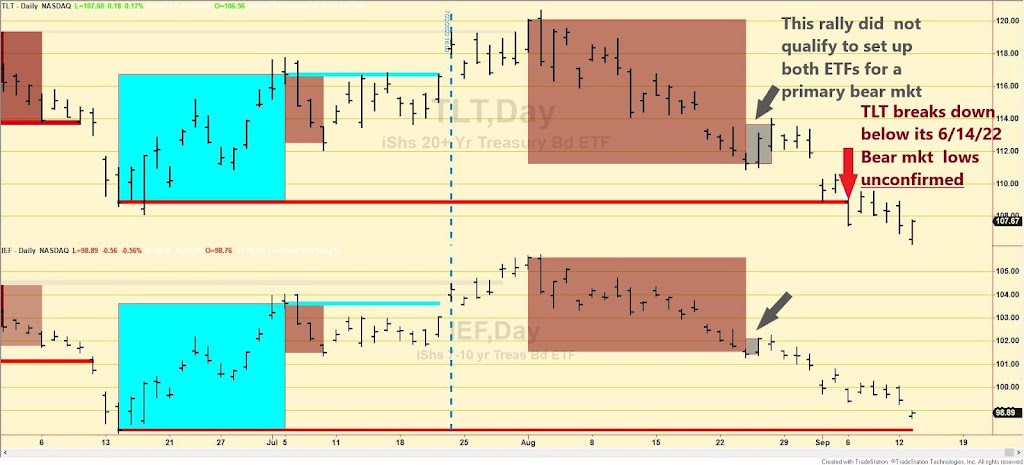

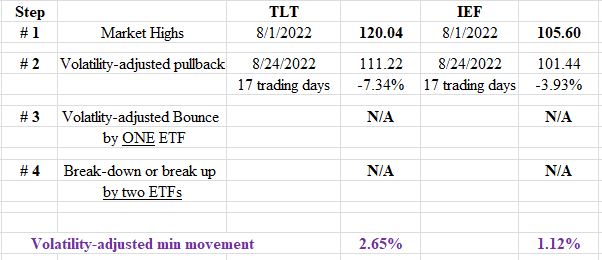

The Principle of Confirmation can save your skin (II). Example 2: IEF breakup turned into a bull trap.

posted on: September 2, 2023

In my previous post, I explained the principle of confirmation in action when applied to U.S. stock indexes. In this post, we will see its application to bonds. The starting point is the primary bear market that was signaled on 9/20/22 (as explained HERE). Following the 10/24/22 bear market lows, a rally followed that qualified […]

Dow Theory Update for September 22: Primary bear market for bonds signaled on 9/20/22

posted on: September 22, 2022

No secondary reaction on the horizon General Remarks: In this post, I provided a thorough explanation concerning the rationale behind my use of two alternative definitions to appraise secondary reactions. TLT is the iShares 20 years + Treasury bond ETF. More about it here IEF is the iShares 7-10 years Treasury bond ETF. More […]

Dow Theory Update for September 13: U.S. bonds flirting with a primary bear market signal

posted on: September 13, 2022

But not there yet! General Remarks: In this post, I provided a thorough explanation concerning the rationale behind my use of two alternative definitions to appraise secondary reactions. TLT is the iShares 20 years + Treasury bond ETF. More about it here IEF is the iShares 7-10 years Treasury bond ETF. More about it here. […]

Dow Theory Update for August 26: U.S. bonds under a secondary reaction against the primary bull market

posted on: August 26, 2022

I am posting before the close. So things might change after the close. So readers beware. US INTEREST RATES General Remarks: In this post, I provided a thorough explanation concerning the rationale behind my use of two alternative definitions to appraise secondary reactions. TLT is the iShares 20 years + Treasury bond ETF. More about […]

Dow Theory Update for August 15: Update on the trend for U.S. bonds on Alessio Rastani YouTube channel

posted on: August 15, 2022

Famed Youtuber and successful trader Alessio Rastani and I have been discussing the current trend for U.S. bonds and its implications for the economy. Click on the link below to see the interview: https://www.youtube.com/watch?v=ey0SPpb6BXk&t=2s And to see our past interview on gold: https://www.youtube.com/watch?v=pG7j0aXlXx8&t=3s I highly recommend Alessio’s channel. It is loaded with great, enjoyable, and […]

Dow Theory Update for July 23: Primary bull market in U.S. bonds signaled on 7/22/22

posted on: July 23, 2022

The primary & secondary trend for precious metals remains bearish US INTEREST RATES General Remarks: In this post, I provided a thorough explanation concerning the rationale behind my use of two alternative definitions to appraise secondary reactions. TLT is the iShares 20 years + Treasury bond ETF. More about it here IEF is […]

Dow Theory Update for July 15: Setup for a potential primary bull market in U.S. bonds completed on 7/8/2022

posted on: July 15, 2022

All trends for precious metals & their ETF miners remain solidly bearish I am writing before today’s close, so things might change. Readers beware. US INTEREST RATES General Remarks: In this post, I provided a thorough explanation concerning the rationale behind my use of two alternative definitions to appraise secondary reactions. TLT is the iShares […]

Dow Theory Update for July 6: U.S. bonds are in a secondary reaction against the bear market

posted on: July 6, 2022

Are bonds signaling an impending recession? I am writing before today’s close, so things might change. Readers beware. US INTEREST RATES General Remarks: In this post, I provided a thorough explanation concerning the rationale behind my use of two alternative definitions to appraise secondary reactions. TLT is the iShares 20 years + Treasury bond […]

Back To Top