Category: Dow Theory applied to Trading

When fundamental Indicators Break Down, Price Still Leads

posted on: July 24, 2025

The LEI and yield curve missed the mark. Price action and margin debt told the real story, and we listened. For decades, investors leaned heavily on two stalwart indicators: the yield curve and the Leading Economic Index (LEI). These tools had an almost mythic reputation for signaling recessions and bear markets. However, as Jim Paulsen […]

Free Webinar: Applying The Dow Theory To Assess Market Trends

posted on: March 25, 2025

Secure your place NOW I’m honored to be joining renowned trader and analyst Dean Christians, CMT Christians of SentimenTrader.com for a special public webinar on March 26th, 2025, from 11:00 a.m. to 12:00 p.m. ET. In today’s turbulent market environment, this event promises to be a must-attend. It will offer a deep dive into sentiment, […]

posted on: March 13, 2025

Rory Guillen of Gillenmarkets.com, a long-time subscriber to our service, has just published a highly insightful article on the most recent Dow Theory for the 21st Century (DT21C) signal. You can read it HERE. The piece offers a clear and practical explanation of how to apply the DT21C, along with its strong track record of […]

Beating the S&P 500: Why Your Stock Picks Might Be Falling Short

posted on: December 23, 2024

The 40-Day Sweet Spot: Rethinking Your Stock Holding Period Most S&P500 constituents fail to outperform the Index in the long run. The evidence provided by Kurtis Hemmerling in his LinkedIn post is compelling and highlights this challenge for individual stock pickers. So, if you buy stocks for the long haul, the odds are greatly stacked […]

Melt up (II): Gold and Silver miners ETFs (GDX & SIL) soar triggering a new bull market signal

posted on: April 5, 2024

Overview: Gold and Silver are in a new bull market of their own, as I explained HERE. Now, the miners have joined the rally, and as of 4/3/24, a new bull market has been confirmed. Therefore, regardless of how we analyze it, the trend in the precious metals sector is bullish, as illustrated in the […]

Exploring Effective Investment Strategies with Giacomo Mondonico on Hustle Hub

posted on: March 20, 2024

Learn How the Dow Theory Can Elevate Your Investment Game Being featured on Giacomo Mondonico’s YouTube channel, Hustle Hub, was an absolute pleasure. In our first interview episode, we explored various investment strategies, carefully assessing their effectiveness. Through our analysis, we found that the Dow Theory stands out as a reliable approach for understanding market […]

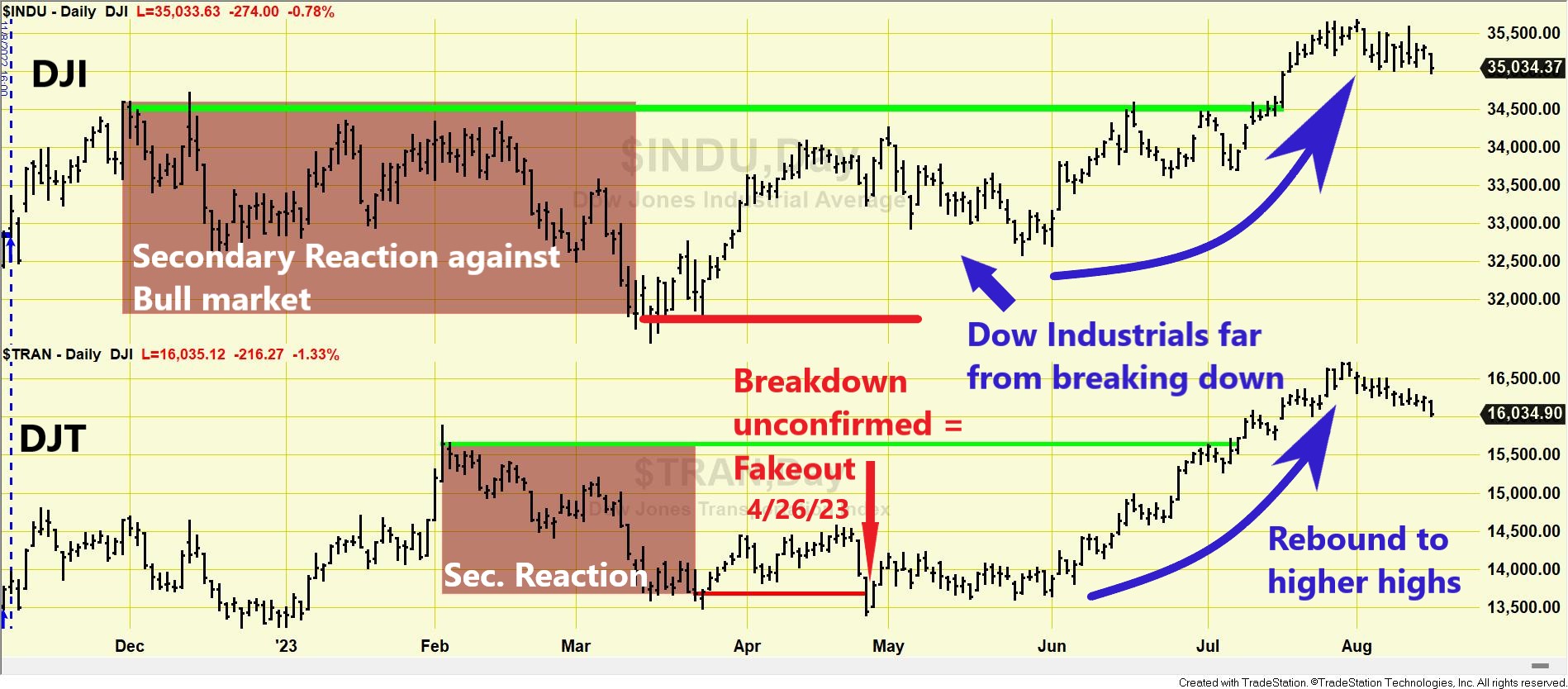

The Principle of Confirmation can save your skin. Example 1. Dow Transportation breakdown

posted on: August 25, 2023

One fundamental tenet of the Dow Theory holds that the movement of one index, when not confirmed by another, should be disregarded. This principle underscores that a Buy or Sell signal originating from one index, such as surpassing a prior high or breaking down below a previous low, carries no significance if it lacks validation […]

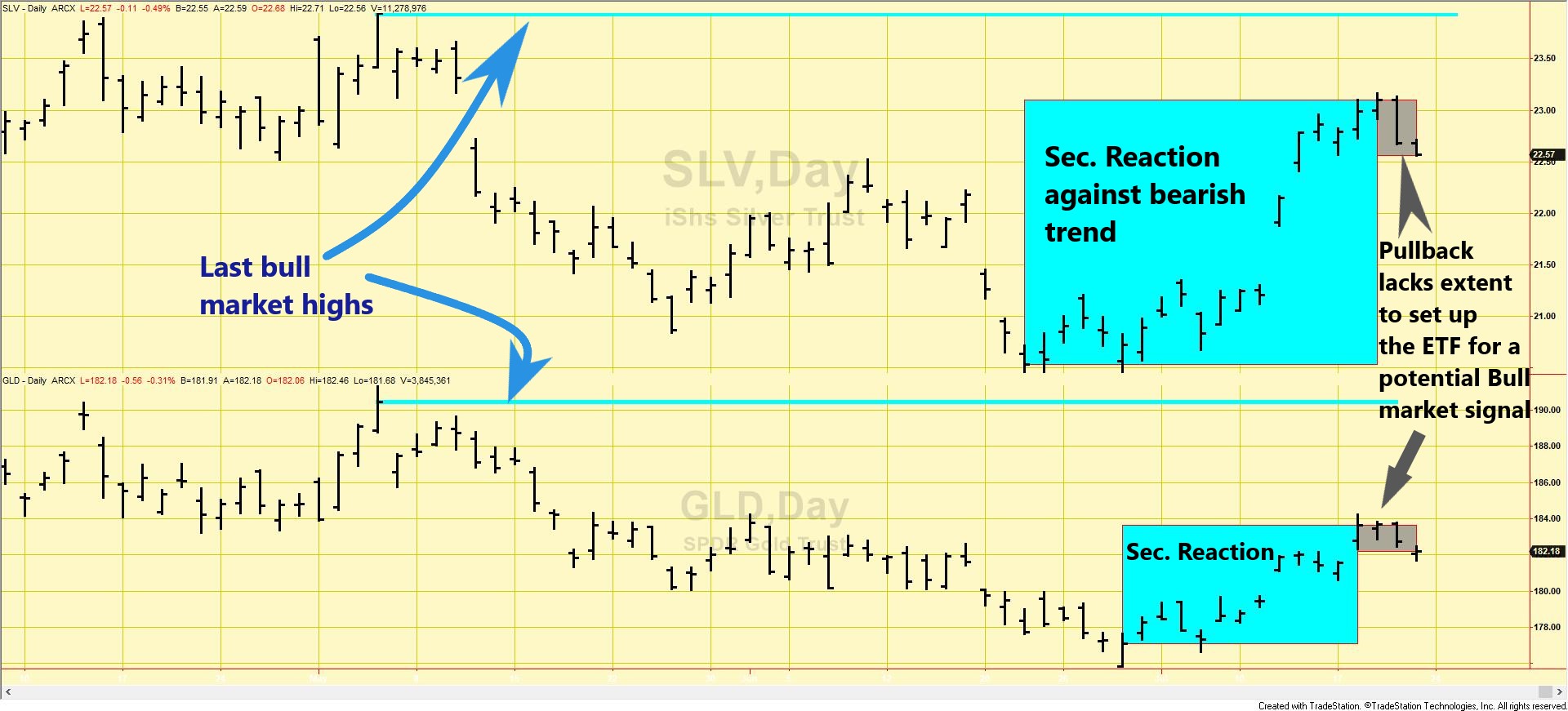

Dow Theory Update for July 22th: Secondary reaction for gold and silver signaled on 7/18/23

posted on: July 22, 2023

Executive summary: The gold and silver (GLD & SLV) have been under a secondary reaction since 7/18/23. The current secondary reaction notwithstanding, the primary trend for gold and silver remains bearish. General Remarks: In this post, I thoroughly explained the rationale behind my use of two alternative definitions to appraise secondary reactions. GOLD AND SILVER […]

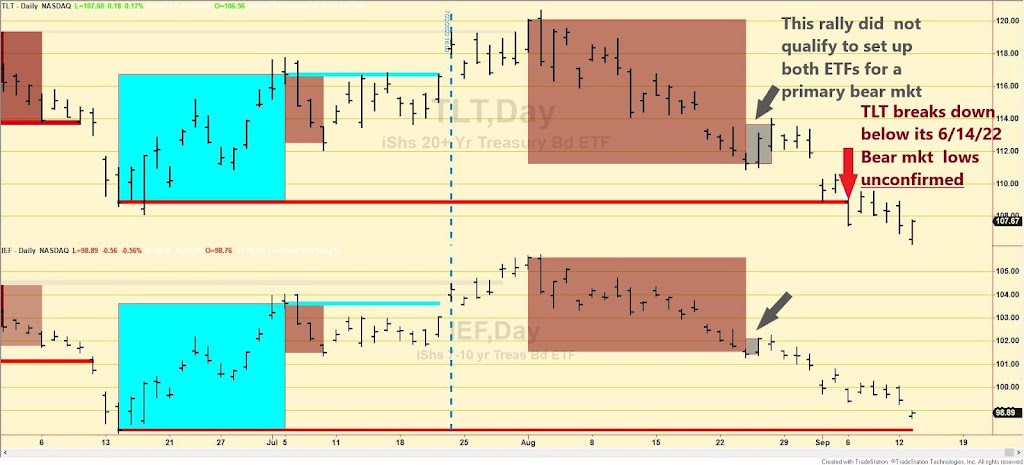

Dow Theory Update for September 13: U.S. bonds flirting with a primary bear market signal

posted on: September 13, 2022

But not there yet! General Remarks: In this post, I provided a thorough explanation concerning the rationale behind my use of two alternative definitions to appraise secondary reactions. TLT is the iShares 20 years + Treasury bond ETF. More about it here IEF is the iShares 7-10 years Treasury bond ETF. More about it here. […]

Boosting the Dow Theory: Relative Strength System with Dow Theory for the 21st Century filter

posted on: April 4, 2022

What happens when one mixes a great timing indicator like the Dow Theory for the 21st Century (DT21C) with a relative strength system? Answer: Even more outperformance and a better risk-reward profile v. Buy and Hold (B&H). Relative Strength (RS) is based on the proven fact that assets (stocks, indexes, sectors, commodities, etc.) […]

Dow Theory Update for August 10th: Divergence and the Dow Theory

posted on: August 10, 2020

Case in point: Precious metals right now Caveat: I’m publishing this post before the close, so things might change. The Dow Theory has it that higher highs (lows) unconfirmed have no validity in signalling changes of trends. We also now that the principle of confirmation has more validity the longer the time frame. Thus, […]

Dow Theory Update for April 8th: New bull market for US stocks signaled on April 6th, 2020

posted on: April 8, 2020

Should we consider the existence of a secondary reaction in precious metals and US interest rates? General remark: Even if you usually only read “US Stocks”, please read the sections concerning precious metals and US interest rates, since they contain several musings which I consider important in order to become more profitable (and drawdown contained) […]

Back To Top