Category: Investment musings

Bull market for the gold and silver miners ETFs (GDX & SIL) confirmed on 9/24/24

posted on: September 27, 2024

Chinese Stimulus Sparks Melt-Up in Gold, Silver, and Mining ETFs. Overview: The markets were sniffing the Chinese stimulus days before it was official. All assets are in a melt-up mode; GDX led the parade, and finally, SIL caught up. The bull market in precious metals has been confirmed. Once again, the principle of confirmation saved […]

Precious Metals Bull Market Confirmed on 9/24/24: Gold and Silver Miners Soar

posted on: September 27, 2024

Chinese Stimulus Sparks Melt-Up in Gold, Silver, and Mining ETFs. Overview: The markets were sniffing the Chinese stimulus days before it was official. All assets are in a melt-up mode; gold led the parade, and finally, silver caught up. The bull market in precious metals has been confirmed. Once again, the principle of confirmation saved […]

3 Fundamental Blunders That Led Me to Trend Following

posted on: September 21, 2024

How Misplaced Trust in ‘Expert’ Opinions Led Me to Embrace Technical Analysis If you’ve been following me for a while, you know I firmly believe in trend following. I’ve learned that price action contains most—if not all—the information you need to succeed in the stock market (or any market, for that matter). But why did […]

Will Small Caps Continue Outperforming Large Caps?

posted on: July 22, 2024

Understanding Small Cap Stocks in the Current Market Expanded on 8/27/24 Will small caps continue outperforming large caps for a considerable time? Or have we just seen a flash in the pan? This is a question on many investors’ minds. While recent trends might suggest a resurgence of small-cap stocks, as shown by the chart […]

Is the Dow Theory Misunderstood? The Truth Behind the Dow Transportation Weakness

posted on: June 29, 2024

Secondary Reaction Highs (Lows): The Key to Market Confirmation Recent weakness in the Dow Jones Transportation Average relative to the Dow Jones Industrial Average has prompted many “experts” to proclaim a bear market signal. They argue that new all-time highs by the Dow Industrials, unconfirmed by the Dow Transports, spell doom for the overall stock […]

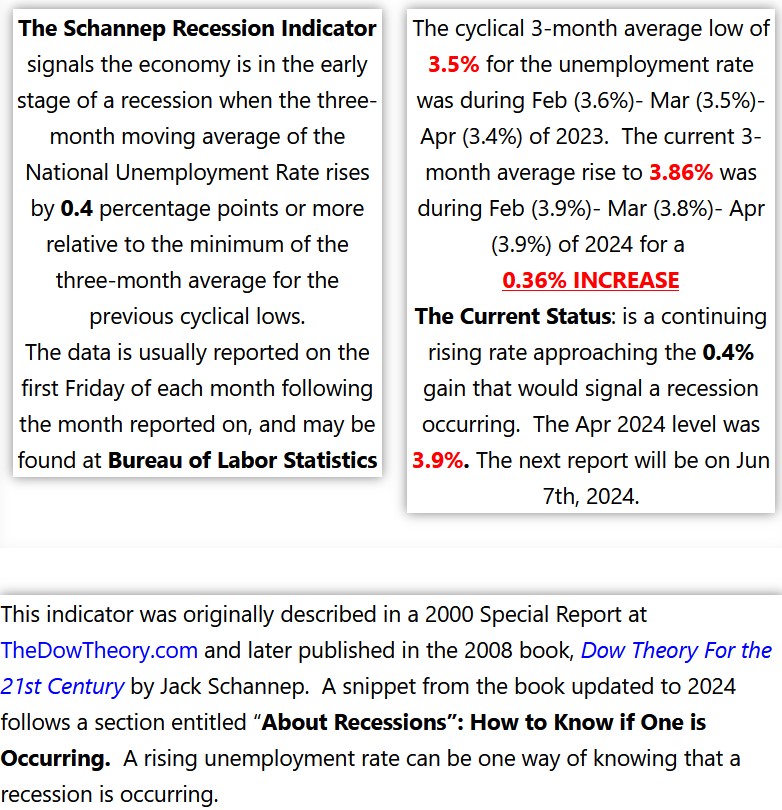

TheDowTheory.com and our recent recession alert featured by Mark Hulbert (MarketWatch)

posted on: June 14, 2024

Understanding the Schannep Recession Indicator and Its Impact on Market Timing We’re honored to have our Schannep Recession Indicator (SRI) featured in MarketWatch by Mark Hulbert on 6/14/24. We wrote a must-read article with the evocative title: “The latest unemployment report has triggered this spot-on recession indicator” Below is the link to the MarketWatch article […]

Unlocking the Power of Trend Following and Relative Strength: A Century of Outperformance

posted on: June 11, 2024

Reducing Drawdowns and Maximizing Returns Trend following and relative strength works. The latest research by Gary Antonacci and Carlo Zarattini, delving into almost 100 years of data, proves conclusively that when done correctly, market timing results in significant outperformance and, more importantly, drawdown reduction. Most investors get blinded by the “outperformance” and forget that the […]

Spotting Recessions and Bear markets: Schannep Recession Indicator vs. Sahm rule

posted on: May 30, 2024

Which one is even better? Spoiler alert: Schannep’s The “Sahm Rule” is a well-known recession indicator created by Claudia Sahm, an economist who worked at the Federal Reserve. This rule identifies the early stages of a recession when the three-month moving average of the U.S. unemployment rate rises by half a percentage point or more […]

Back to “divergent” interpretations of the Dow Theory

posted on: May 27, 2024

Setting Dow Theory concepts straight amidst so much “fake” Dow Theory. Recent Transport weakness relative to the Dow Industrials prompted many “experts” to proclaim that this is a bear market signal. Let’s clarify the concepts. First, divergence and lack of confirmation, while similar, are not the same and have different implications. Divergence entails one […]

Alessio Rastani Features TheDowTheory.com: Update on the technical landscape for Bitcoin and Ethereum

posted on: April 29, 2024

Alessio Rastani has a knack for making excellent and content-rich videos. As a follower of Alessio’s work for many years, I can attest that he tends to be on the right side of the markets most of the time. In his latest video, he delves into the current technical landscape of Bitcoin and Ethereum. I’m […]

Exploring Effective Investment Strategies with Giacomo Mondonico on Hustle Hub

posted on: March 20, 2024

Learn How the Dow Theory Can Elevate Your Investment Game Being featured on Giacomo Mondonico’s YouTube channel, Hustle Hub, was an absolute pleasure. In our first interview episode, we explored various investment strategies, carefully assessing their effectiveness. Through our analysis, we found that the Dow Theory stands out as a reliable approach for understanding market […]

Critical Stock Market Update: The classical Dow Theory signaled a bull market on 2/8/24

posted on: February 13, 2024

Reminder: The Dow Theory for the 21st Century provides even more precise timing for the stock market I will explain the latest “classical” Dow Theory buy signal in this post. I must state that I don’t trade this kind of Dow Theory, despite its good record of outperformance and drawdown reduction vs. Buy and Hold. […]

Back To Top