Dow Theory Update for October 28: The four requirements of a good trend following system

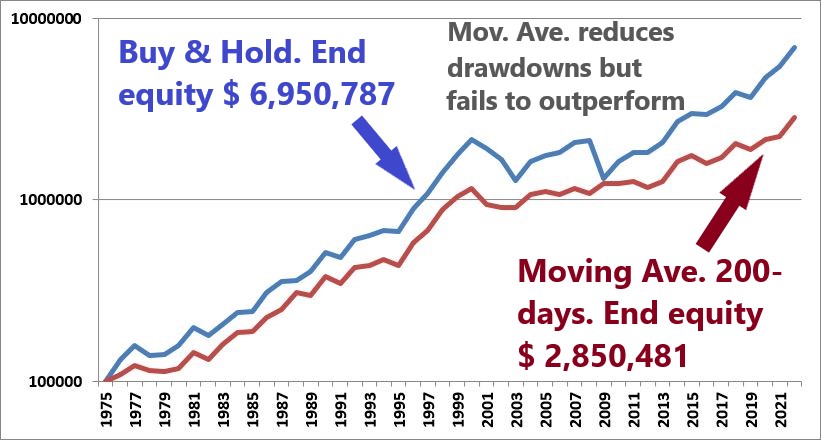

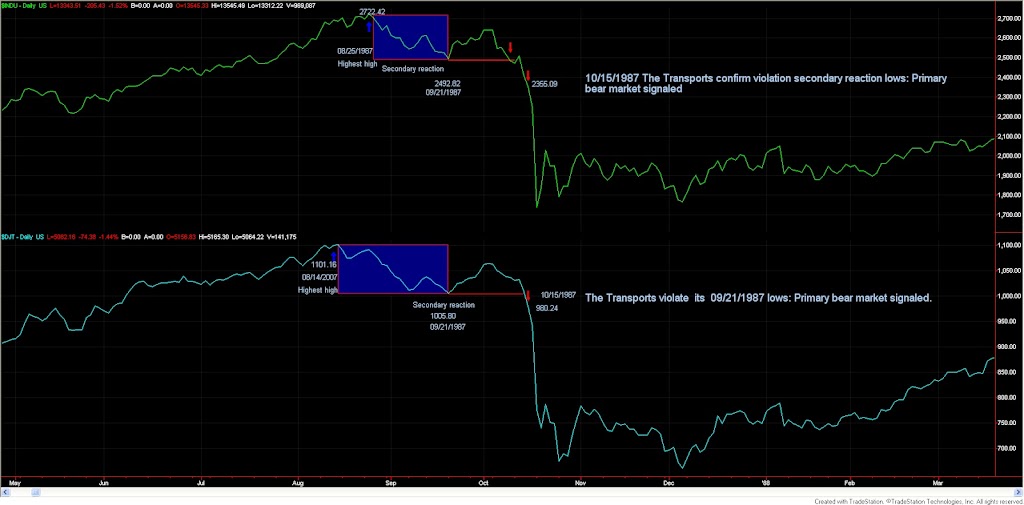

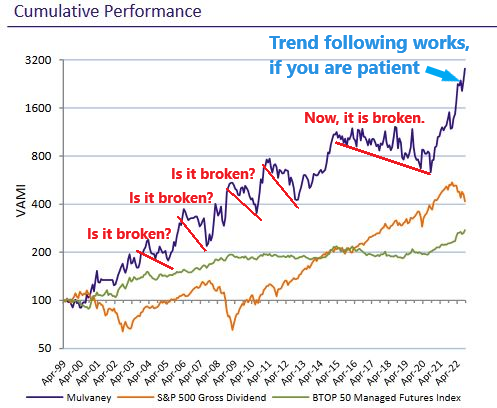

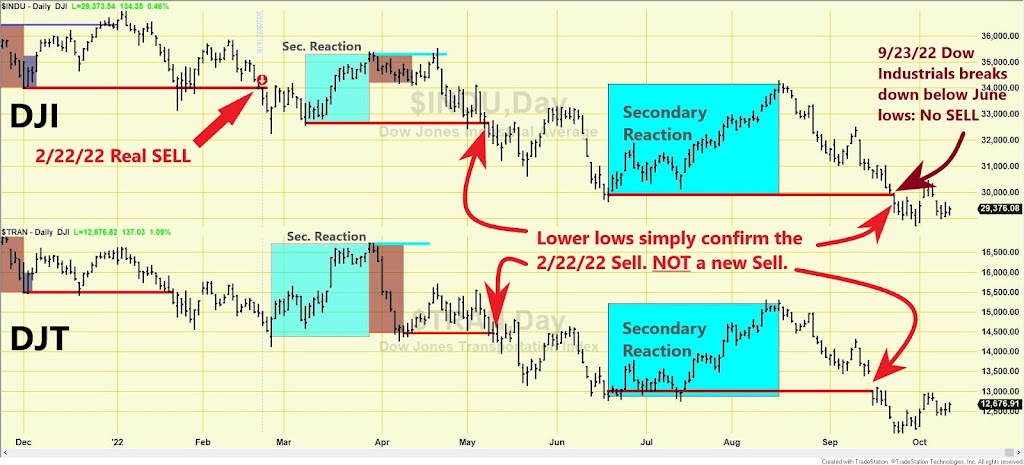

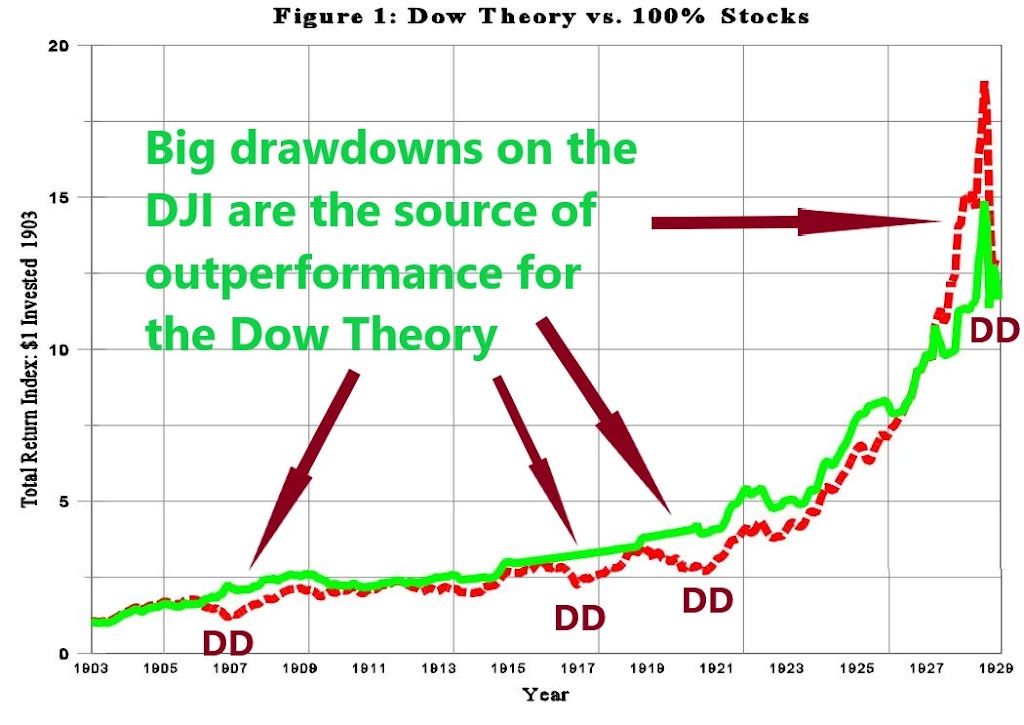

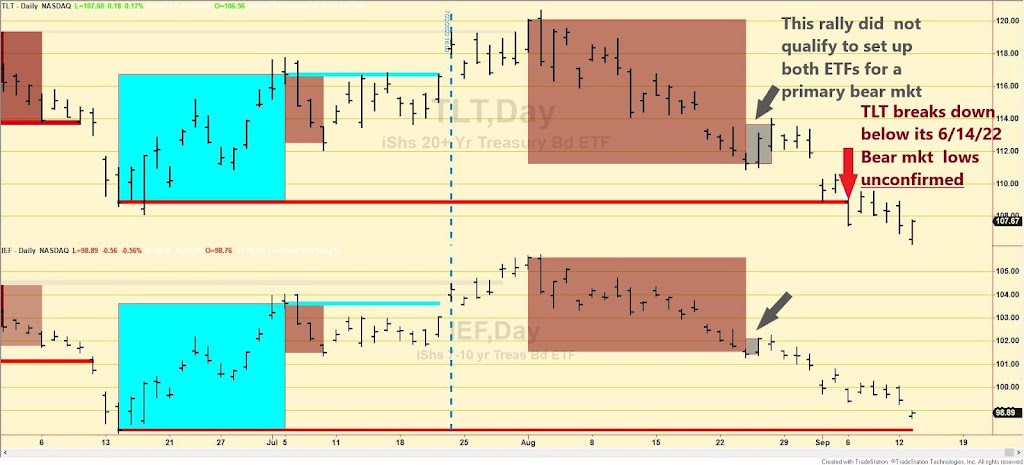

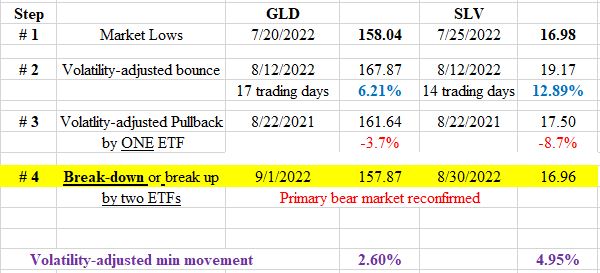

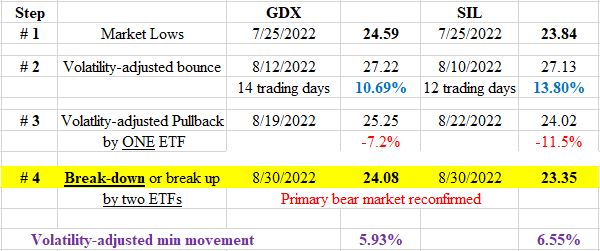

Good (and less good) trend following This is an important post as it will dispel some trend-following myths. I plan to expand this post in the future or write additional posts on this subject. What makes an excellent trend-following system? A good trend-following system must meet four requirements: […]