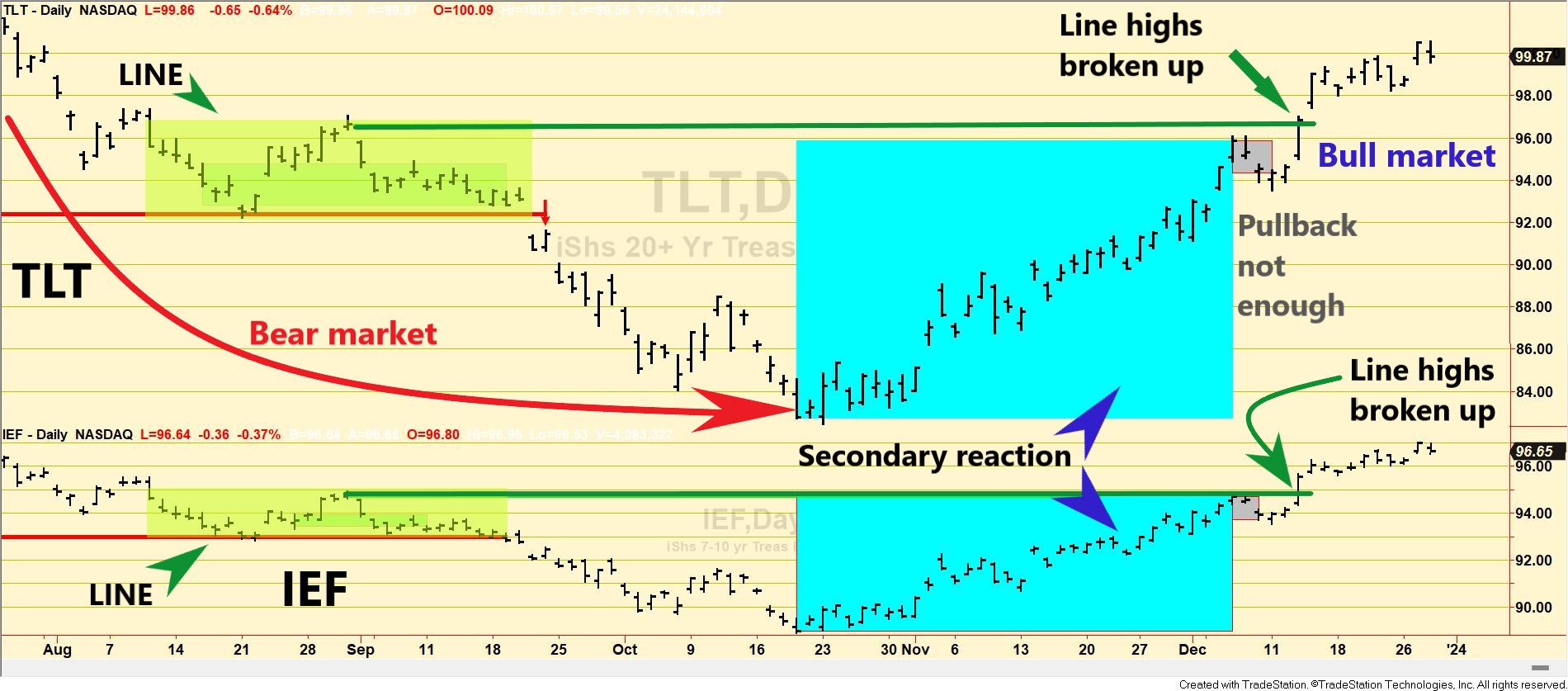

TLT and IEF Watch: Are Bonds on the Brink of a Primary Bear Market Signal?

Not yet, but the setup for a potential bear market signal in US bonds has been completed. General Remarks: In this post, I thoroughly explained the rationale behind using two alternative definitions to appraise secondary reactions. TLT is the iShares 20 years + Treasury bond ETF. More about it here IEF is the iShares 7-10 […]