Spotting Recessions and Bear markets: Schannep Recession Indicator vs. Sahm rule

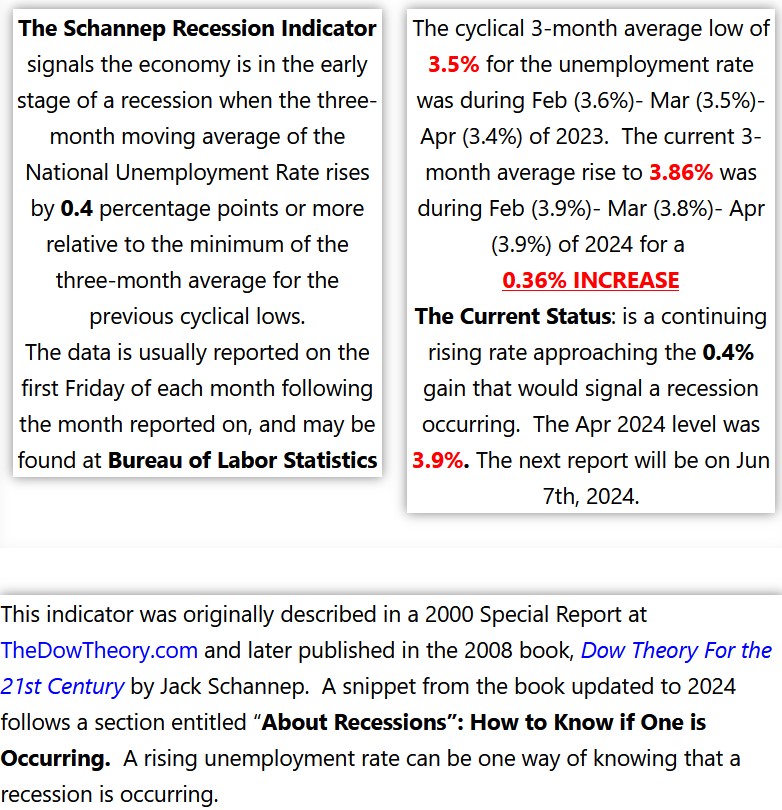

Which one is even better? Spoiler alert: Schannep’s The “Sahm Rule” is a well-known recession indicator created by Claudia Sahm, an economist who worked at the Federal Reserve. This rule identifies the early stages of a recession when the three-month moving average of the U.S. unemployment rate rises by half a percentage point or more […]