Category: Investment musings

Strategic Market Timing for Luxury Superyacht Construction

posted on: January 16, 2026

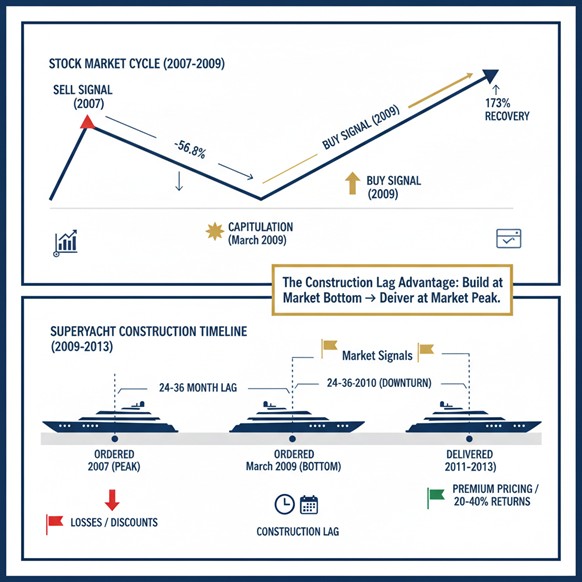

Super Yacht Builders’ Guide to Counter-Cyclical Growth By George Morton, PhD, January 2026 Executive Summary Dow Theorist Hamilton, in his 1922 book The Stock Market Barometer: A Study of Its Forecast Value, described the averages as a reliable barometer for forecasting trends in business activity (including industrial aspects). He emphasized its predictive power for economic/industrial […]

The Principle of Confirmation Can Save Your Skin (V) / Example 5: Bitcoin’s breakup that was a bull trap

posted on: November 14, 2025

Applying the Confirmation Principle to Bitcoin In four earlier analyses (HERE, HERE, HERE , and HERE ), I showed how the Principle of Confirmation works across U.S. stock indexes, bonds, crypto, and precious metals. In each case, the principle proved invaluable in filtering out false moves. The idea is simple but powerful: a breakout or […]

Gold and Silver Miners ETF at a critical juncture: Setup for a potential Bear market signal completed on 11/10/25

posted on: November 12, 2025

Overview: The gold and silver miners ETF reached a make-or-break moment on 11/10/25. The setup for a potential bear market is complete, and the line in the sand has been drawn. Please mind the word “potential”. Only if the two read lines I show in the chart below are jointly pierced, the trend will shift […]

The Principle of Confirmation Can Save Your Skin (IV) / Example 4: Two Silver Breakdowns That Turned into Bear Traps

posted on: October 25, 2025

Applying the Confirmation Principle to precious metals In three earlier analyses (HERE, HERE, and HERE), I showed how the Principle of Confirmation works across U.S. stock indexes, bonds, and crypto. In each case, the principle proved invaluable in filtering out false moves. The idea is simple but powerful: a breakout or breakdown that is not […]

When Market Timing Meets Quant Research: The Results Speak for Themselves

posted on: October 17, 2025

How world-class quant research and timing filters slash drawdowns and boost returns. What happens when you combine a strong stock-picking strategy with first-class trend following? Something remarkable happens: returns surge, drawdowns shrink, and consistency improves dramatically. That’s exactly what the two charts below reveal. This article was originally a brief social media post, but the […]

Why Bitcoin’s Bull Market Isn’t Over Yet

posted on: October 7, 2025

On October 3rd, I had the pleasure of joining Maurizio Pedrazzoli Grazioli’s podcast for the second time. We picked up right where we left off from our previous conversation—when we called the bottom of Bitcoin on April 8th—and once again, we explored some bold bullish scenarios that, at the time, were far from obvious. Fast […]

Why Today’s Stock Market Valuations Are Not Excessive: Liquidity, Capital Accumulation, and the Repricing of Risk

posted on: September 16, 2025

How liquidity and rising wealth explain today’s high valuations in the stock market Introduction Many market commentators warn that stock valuations are dangerously high, pointing to elevated price-to-earnings (P/E) ratios and market cap-to-GDP levels as evidence of a bubble. These warnings often rely on outdated benchmarks. What was considered expensive fifty years ago isn’t necessarily […]

When fundamental Indicators Break Down, Price Still Leads

posted on: July 24, 2025

The LEI and yield curve missed the mark. Price action and margin debt told the real story, and we listened. For decades, investors leaned heavily on two stalwart indicators: the yield curve and the Leading Economic Index (LEI). These tools had an almost mythic reputation for signaling recessions and bear markets. However, as Jim Paulsen […]

Two new interviews with Alessio Rastani on Youtube

posted on: July 7, 2025

Once again, I was invited by Alessio Rastani to join him in two new videos. Since I was in my 80% work, 20% vacation mission across Europe, I was not fully equipped, so we had to do an “unplugged” performance. No fancy mic, nor headphones or hi-end speakers on my end. Just my reliable laptop, […]

The Real Problem with Buy & Hold—and What to Do About It

posted on: June 14, 2025

Three Smarter Ways to Cut Drawdowns Without Killing Performance The core issue with buy-and-hold investing is simple: drawdowns. Big ones. They may be inevitable, but that doesn’t make them any less damaging—both financially and psychologically. To address this, many investors turn to buffered ETFs, hedging with puts, or going short. But there’s a catch: these […]

Gold and Silver in Sync: The Bull Marches On

posted on: June 9, 2025

Silver Seals the Deal: Bull Market Reconfirmed Overview: On 6/5/25, silver broke above its 10/22/24 highs. It confirmed gold’s previous breakup on 1/30/25. Accordingly, the primary bull market has been confirmed. By the way, the recent price action of SLV and GLD offers a powerful reminder of how the principle of confirmation can protect you […]

Breadth Thrust on April 24th 2025 increases the odds that the bottom is behind us

posted on: April 24, 2025

I reproduce a post on LinkedIn with some additions that I think is relevant to our readers. On April 24, 2025, a Zweig Breadth Thrust signal emerged, a rare and historically bullish indicator for the stock market. Skeptical of social media claims, I verified the signal using TradeStation, my trusted trading software, which confirmed the […]

Back To Top